从各大新闻头条来看,固态电池似乎已经“触手可及”,并将在不久的将来广泛应用至电动汽车领域,并在较小范围内应用至其他消费电子产品领域。在2019 年 9 月的北美电池展(2019 Battery Show of North America)上,有关固态电池的专家讨论和演讲数不胜数。理想很美好,但现实却很残酷:在展会的“固态电池可行性”圆桌讨论会上,专家们一致认为,这项技术至少在未来五年内都无法达到量产电动汽车的标准。

尽管如此,展会上的大多数专家都认为,固态电池势必将进入电动汽车领域,只是时间早晚而已。一位分析师估计,仅在 2018 年,固态电池企业就拿到了 5 亿美元投资。

北美电池展的五人专家小组包括一位来自福特的代表、一位来自丰田的代表、两位电池开发商和一位大学研究人员,这些专家均未质疑固态电池技术的潜力。由于锂箔阳极可以克服非液体电解质电极设计中常见的电导率低的问题,因此得到了最广泛的应用,也正因如此,固态电池技术有时也被称为锂金属电池。目前,固态电池已经应用至心脏起搏器等应用,但如何才能以合理的成本批量生产用于汽车的固态电池,尚不得而知。

A123 Systems 电池开发副总裁 Brian Sisk 表示:“我们开发固态电池是为了节省成本。”他说,固态电池据说有潜力将当下锂离子电池的能量密度提高一倍。这意味固态电池的成本效益是锂离子电池的两倍,此外还有在缩小尺寸和降低重量方面的优势。

但是 Sisk 同时表示,除非成本降低至当今锂离子电池之下,否则固态电池很难真正参与汽车领域的竞争。尽管,一些豪华汽车或高性能汽车可能愿意为了增加续航里程或降低重量而为电池支付更高的价格,但固态电池要想登陆量产汽车,则单位千瓦时成本必须继续降低。

福特固态电池部门负责人 Venkat Anandan 表示,公司“正在积极研究多种类型的固态电池”,并表示福特正在积极争取在能源密度、安全性和成本方面的优势。2019 年 4 月,福特宣布将投资位于科罗拉多州的固态技术开发商 Solid Power。除了福特,宝马、现代和三星也是 Solid Power 的投资人。Anandan 表示,他认为固态电池真正应用至量产电动汽车至少还需要五年时间。

与此同时,电池开发商 SolidEnergy Systems 公司首席执行官小组成员 胡启朝 对固态电池技术发展的态度更为乐观,但也表示确实存在一些问题。SolidEnergy 公司制造的半固态电解质固态电池已经应用至一些高海拔长途车辆、消费者无人机和其他航空航天应用。胡先生表示,他相信汽车领域将在未来3-5年内迎来半固态电池,并在七到十年内迎来锂金属固态电池。北美丰田研究所材料研究部门首席科学家小组成员Timothy Arthur 表示:“丰田长期以来一直以固态电池为重,这已不是秘密,”并提醒我们丰田已承诺将在 2020 年东京奥运会期间投运一批使用固态电池的电动汽车。但是,他并未直接预测固态电池将何时用于量产电动汽车。

A123 System 公司的Sisk 表示,该公司计划明年启动一条使用石墨阳极的固态电池生产线,并于此同时继续克服锂金属电池在成本和其他可制造性方面的挑战。

Sisk 补充说,固态电池的单位成本并不一定必须降至当今锂离子电池的水平。这是因为尽管固态电池的成本可能更高,但可以在系统层面降低其他车辆成本。他详细介绍说,比如,由于固态电池没有着火或过热的风险,因此所需的电池保护结构可能更少,相应的电池管理和热管理成本也会降低。

作者:Bill Visnic

本文原发表于SAE《自动驾驶车辆工程》杂志

Solid-state batteries are the “reach” energy-storage technology slated to take electric vehicles (EVs) – and to a lesser extent, other consumer-electronic products – to the next level. And at September’s 2019 Battery Show of North America, speaker panels and presentations about solid-state certainly were in abundance. Just one problem: experts at the show’s Solid-State Battery Feasibility roundtable discussion where brutally realistic in agreeing the technology won’t meet criteria for mass-production EVs for at least five years.

The reasons for the five-year wait are manifest, but the two primary factors are familiar to the automotive sector: cost and manufacturability.

Nonetheless, most experts here agree that solid-state batteries for EVs certainly are not an “if,” but a “when. ”One analyst estimate indicates $500 million was invested in solid-state battery ventures in 2018 alone.

None on the five-person panel that included representatives from Ford and Toyota, two cell developers and a university researcher, questioned the potential or the science for solid-state technology, often referred to as lithium metal because of the lithium-foil anode widely used to help the design overcome the reduced-conductivity typical of non-liquid electrolytes. Solid-state batteries already are in use for heart pacemakers and other applications, but determining how to manufacture the batteries for automobiles in volume at a reasonable cost currently isn’t possible.

“We’re doing this [developing solidstate batteries] for cost,” said Brian Sisk, vice-president of battery development at A123 Systems. He said the technology’s oft-touted potential to double the energy density of current conventional lithium-ion batteries means a concurrent potential to halve battery cost for a given capacity (not to mention reduce size and weight).

But Sisk said he is certain that unless and until solid-state technology can be installed in EVs at less cost than today’s lithium-ion batteries, solid-state batteries will not be able to compete. There may be “premium” or high-performance applications for which a higher-cost battery might be an acceptable trade for longer range or reduced weight. But for mass-production vehicles, he believes today’s cost per kilowatt-hour ratio must be improved for solid-state technology to be adopted.

Venkat Anandan, Ford’s Group Leader, solid-state batteries, said the company is “actively looking at many types of solid-state batteries,” saying Ford is anxious to reap the energy-density, safety and cost benefits. Ford announced in April that it is investing in Colorado’s Solid Power, a developer of solid-state technology that also counts BMW, Hyundai and Samsung as investors. Anandan said he believes it will be at least five years before solid-state batteries will be viable for mass-produced EVs.

Meanwhile, panelist Qichao Hu, CEO of battery developer SolidEnergy Systems, was slightly more optimistic in his timeline for solid-state technology – but with some caveats. His company already is manufacturing solid-state batteries with semi-solid electrolyte for high-altitude, long-endurance (HALE) vehicles, consumer drones and other aerospace applications. Hu said he believes the semi-solid design may be vehicle-applicable in 3-5 years and sees lithium-metal designs available in 7-10 years. Panelist Timothy Arthur, principal scientist – Materials Research Dept. at Toyota Research Institute of North America, said, “It’s no secret that Toyota’s been high on solid-state batteries for a long time,” and reminded that the company has promised to have vehicles with solid-state batteries in operation during the 2020 Summer Olympic Games in Tokyo. But he did not directly speculate about when solid-state batteries will be fitted to production EVs.

A123’s Sisk said the company intends to have a pilot production line in operation next year using a graphite anode while the company continues to work on the cost and other manufacturability challenges of lithium-metal.

He added that cost at the battery-cell level may not necessarily have to achieve parity with today’s lithium-ion cells; although solid-state battery cells might cost more, they could deliver cost-reductions at the systems level. Because solid-state batteries have no risk of fire or thermal runaway, he said battery-protection structure potentially could be reduced, as could battery-management and thermal-management costs.

Author: Bill Visnic

Source: SAE Automotive Engineering Magazine

博世曾研究过固态电池,但随后决定不再继续开发或制造电池。(博世)

博世曾研究过固态电池,但随后决定不再继续开发或制造电池。(博世) 比较锂离子电池与固态电池的特性与设计(Solid Power)

比较锂离子电池与固态电池的特性与设计(Solid Power) 与现有的锂离子电池相比,SolidEnergy Systems展示了固态电池可能减小的尺寸。(SolidEnergy系统)

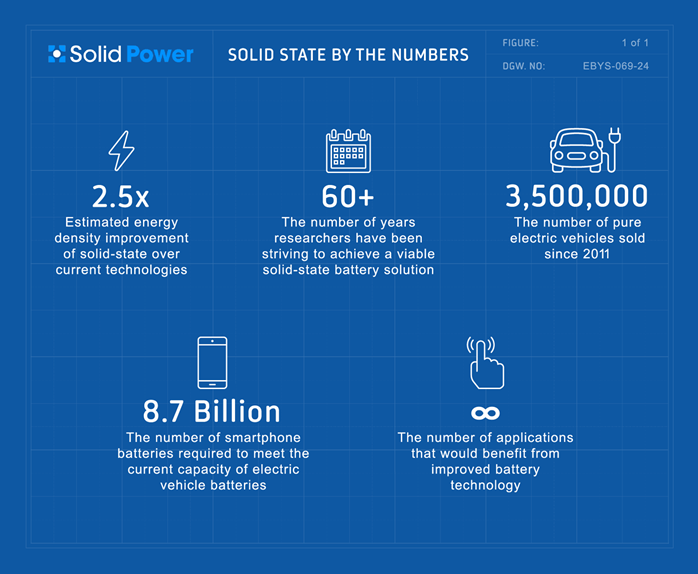

与现有的锂离子电池相比,SolidEnergy Systems展示了固态电池可能减小的尺寸。(SolidEnergy系统) (Solid Power)

(Solid Power)