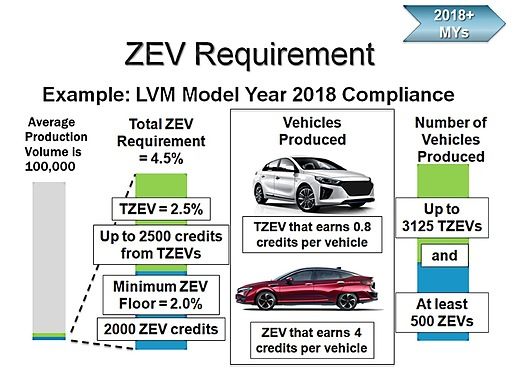

上图举例说明了大型汽车厂商要如部署零排放车辆(ZEV)和过渡性零排放车辆(TZEV),以满足ZEV法规要求。按照规定,每10万辆汽车中须有500辆ZEV。

上图举例说明了大型汽车厂商要如部署零排放车辆(ZEV)和过渡性零排放车辆(TZEV),以满足ZEV法规要求。按照规定,每10万辆汽车中须有500辆ZEV。 根据UDDS体系(城市工况和纯电动续航里程),TZEV积分最多为1.1,但如能通过US06加速负重测试,则可以获取额外的0.2个积分。ZEV的积分上限为4.0.

根据UDDS体系(城市工况和纯电动续航里程),TZEV积分最多为1.1,但如能通过US06加速负重测试,则可以获取额外的0.2个积分。ZEV的积分上限为4.0. ZEV和TZEV积分要求逐年递增,到2025年,ZEV和TZEV的最低比例分别需达到16%和6%。

ZEV和TZEV积分要求逐年递增,到2025年,ZEV和TZEV的最低比例分别需达到16%和6%。 如果GHG得分超过要求,可以额外获得特别积分,能让2018和2019年的ZEV和TZEV合规压力“减负”一半。

如果GHG得分超过要求,可以额外获得特别积分,能让2018和2019年的ZEV和TZEV合规压力“减负”一半。

加利福尼亚州零排放车辆(ZEV)强制法规将从2018年起大幅简化。在得到这一好消息的同时,相应的挑战也随之而来:由加州空气资源委员会(CARB)与俄勒冈州等实行“第177号条款”的9个州所制定的新规将会逐年提高要求,要想完达到合规,将变得愈发困难。而据统计,ZEV法规将会影响到美国市场上近三成的轿车与轻型卡车。

根据CARB的数据显示,在2002年到2004年间,交通运输领域产生的温室气体(GHG,即二氧化碳)占到加州温室气体排放总量的38%。

新规的目标是到2030年减少40%的温室气体排放,到2050年则能达到80%的降幅。对于汽车部门,ZEV强制令似乎有着相当清晰的规划。此外,ZEV也已经开始对老旧的传统发动机进行升级换代,以避免其所带来的负面影响。

谁能置身事外,谁又难逃一劫?

在加州,年产量不超过4,500辆的小型汽车制造商(对于独立制造商则放宽到10,000辆)不会受到ZEV强制法规的影响。而年产量20,000辆、年收益不超过400亿美元厂商被归为中型整车厂,这部分厂商受到的影响很大。

CARB使用BEV作为纯电动车(battery electrics)的缩写,避免人们误认为ZEV中的“E”和“V”指的是电动汽车EV(electric vehicle)。在2018年以前,汽车厂商主要通过生产纯电动车来满足ZEV强制标准要求,并辅以其他一些计分标准不同的车型,如油电混合动力车——即AT PZEV(先进技术部分零排放车辆)、PHEV(即插电式混合动力车,在2018年前也称为“改进型AT PZEV”)以及最基本的非混合动力的PZEV(部分零排放车辆)。

最基本的PZEV对温室气体排放量并无积极影响,但它符合加州的超低排放车辆(SULEV)新规,即要求汽车的尾气排放(包括碳氢化合物、碳氧化物、氮氧化物及其他微粒)要比传统车辆的平均排放量低90%。PZEV的发动机和催化系统都经过了改良,蒸发排放量为零。它在发动机进气口有一个碳排放过滤捕集装置,可以提高密封性。PZEV的规定报废年限为15年,即24.14万公里(合15万英里),配有专门的车载诊断设备。

PZEV和AT PZEV的“加分项”规定执行到2017年就结束了,但是没用完的“分数”可以存到2018使用。不过遗憾的是,这些剩余分数的价值将会大打折扣,中型OEM需按25%折算,而大型汽车厂商则只能按6.75%折算。

新增类别——过渡性零排放车辆(TZEV)

升级后的AT PZEV能到达SULEV的标准,PHEV纯电动续航里程在16公里以上,同时配有氢燃料内燃机(该内燃机在EPA 城市道路循环(UDDS)或者城市工况下续航里程至少为250英里/400公里)。这一新类别被称为“过渡性PZEV”(TZEV),符合2018年开始执行的新规标准。在纯电动模式UDDS工况下,车辆各项性能指标至少比原厂提供的参数高30%。而对于在US06模式(指重载加速模式)下,如纯电动里程数超过16英里,则会另有0.2的TZEV奖励分。

工程师也知道政府的新规不会那么简单。事实上,只有以下这几类汽车能在2018年继续获得ZEV加分:

-

纯电动BEV,累积分(最高4.0)按UDDS工况计算;

-

燃料电池车;

-

上文提到的TZEV;

-

老年社区内电动汽车:最高时速在32-40公里/20-25英里(可获得适量加分)。

此外,可能还会有“BEVx”这一类别出现,这是一种特殊的混合动力车:纯电动续航里程可以达120公里/75英里以上,同时搭载获得SULEV认证的内燃机和油箱,增程里程不得超过纯电动模式的续航里程。

举个例子,宝马i3电动车的纯电动续航里程数约为180公里/114英里,再加上总价3850美元的增程内燃机(或发电机)和7.2升的油箱,总续航里程为288公里/180英里。双缸650cc的电动踏板车的发动机用于对电池组充电,使其电量维持在30%左右。

燃料电池车与BEV属于同一类别,所得的积分大致相同。如果内燃机使用的是氢燃料,且UDDS工况下续航里程数不少于400公里,则可以获得最低0.75的ZEV积分,并同时获得额外0.5分的VMT(汽车行驶里程)奖励分。这个转换的公式借用自PHEV类别的计算方式,用来确定对等的纯电动续航里程数(equivalentall-electric range / EAER)。

2018年的强制法规特别指出,大型OEM的ZEV累积分数需要达到其2018年销售量的4.5%,其中的2.5%(占总量的55%)可以用TZEV分数抵扣。年度总分要求以2.5个百分点的速度逐年递增,而TZEV的递增速度则为每年0.5个百分点。中型制造商的全部ZEV分数都可以通过TZEV获取,压力可谓大为缓解。

另外,2018年之前累积的ZEV分数可以存起来,但ZEV得分不足的部分不能用CAFÉ得分抵扣。例如,菲亚特克莱斯勒已经存了90,722个积分(据业内消息,其中大多数是从特斯拉买来的),以应对其单位能源效率不达标的问题。尽管菲亚特自2013年起就在加州和俄勒冈售出了不少(具体数字没有披露)500e型纯电动车,但据公布的销售报告显示,销售业绩平平。另外PHEV版Pacifica Minivan也能贡献一些TZEV积分。

新规相对2009-17规定的变化

之前的2009-17法规把在加州年销量不超过60,000辆的汽车制造商归为中型制造商,并允许这部分制造商用PZEV转换得来的分数来完成ZEV的指标,同时规定大型制造商需要在2015-17年期间将ZEV的比例达到14%,不过其ZEV实际比例只需要达到3.0%即可(即在加州年销售每10万辆车需要3000积分,换言之就是只要有750辆车的积分达到4.0即可)。

但这次中型厂商的上限标准从年销售60,000辆车被砍到20,000辆,是因为监管机构对市场做了重新评估,将全球销量也一起考虑了进来。根据2008至2010年的平均销量,此前只有通用、菲亚特克莱斯勒、福特、日产、丰田和本田这几个品牌位列加州的“大制造商”行列。

每辆ZEV只要纯电动续航里程不低于80公里/50英里,就能得到2.0个积分。而其他分数则可以通过PZEV、AT PZEV以及改进型AT PZEV得分进行补充。而使用氢燃料或压缩天然气(CNG)作为动力的PZEV还能获得额外分数。PHEV续航里程数不少于16公里/10英里,或是搭载再生制动及怠速启停系统等“先进部件”的汽车,也能享受到额外加分。

多年来,整个行业的零排放车辆销售中,加州一直占大头,因为这里的广告宣传很到位,气候宜人,并且充电基础设施也较为完备。但在新规之下,所有适用ZEV/177号法规适用的州(主要是俄勒冈和美国东北大部分州),销量都将按比例相应进行计算。但积分可以转移,没有生产BEV的公司可以选择购买积分,就像之前提到的菲亚特克莱斯勒从特斯拉那里购买积分一样。

根据2018年的强制法规,只有非加州的燃料电池汽车销量才可“转移”。而如果这些销量是跨州计算的(如在俄勒冈州销售,在新泽西州算分),那么就要有30%的积分手续费(即原130分,只能计100分)。

“超额合规”为ZEV新规“减负”另辟蹊径

目前已经存入积分银行的ZEV积分可以在2025年之前随取随用。而除此以外,新规还包括了“GHG-ZEV超额合规”条款。OEM可以将二氧化碳排放值定在至少低于合规目标值2.0克(具体情况要参照车辆型号以及大小)的水平,并在综合参考计算,在UDDS工况下的EPA联邦测试协议的测量值(权重55%)和EPA高速公路燃料经济性测试的测量值(权重45%)。汽车制造商的ZEV得分必须根据这一目标值进行计算。

尽管预测数据尚未获得,但根据CARB的估算,加州售出的车辆约有10%到20%将可获得超额加分。加分只能在所获得的车型年当年使用,而且仅限获得加分的企业使用(不可用于交易)。根据新规,2018年和2019年的抵扣上限为50%,2020年降为40%,2021年则只有30%。

另外一项帮助合规的手段,也是为鼓励制造商在ZEV/177号条款适用的州销售ZEV,以刺激当地需求而制定的。在美国东北部增加ZEV销量是非常困难的,因为该地区的大多数州冬季气候寒冷,而汽车供暖需要能源,故而会影响续航里程。如果不采用特殊设计——如车辆预热、增程发动机、热泵乃至蓄热装置等,以缓解此类问题,ZEV在那里的销售将举步维艰。

如果汽车制造商没有达到ZEV分数要求,差额需在下一个车型年补足,且只能用ZEV积分填补。中型制造商的填补期限可以放宽到3年,且可以用ZEV或TZEV的分数抵扣。如到期仍未达标,则将必须缴纳每积分5000美元的罚金。

The good news about the California zero-emission vehicle (ZEV) mandate is that it is greatly simplified starting in 2018. What will be a challenge: the new regulation, formulated by the California Air Resources Board (CARB) and also followed by Oregon and eight other so-called 'Section 177' states, is more difficult each succeeding year. There are fewer ways in which it can be met. Nearly 30% of the U.S. car/light duty truck market is tied to the ZEV mandate.

CARB data show transportation accounted for 38% of California greenhouse gas (GHG/CO2) emissions, reported for the 2002-04 period.

Regulation is intended to reduce GHG by 40% by 2030, and 80% by 2050. The ZEV mandate seems to provide a clearcut path for the automotive sector. Further, ZEVs are seen avoiding deterioration factors associated with ageing conventional engines.

Who's exempt and who gets breaks?

Small carmakers who sell up to 4,500 units per year in California (up to 10,000 for independent makers) are exempt from the ZEV mandate. Intermediate size OEMs (up to 20,000 units/yr with annual revenue of $40 billion or below) get some significant breaks.

Because the 'EV' in ZEV does not necessarily refer to an electric vehicle, CARB uses BEV as its acronym for battery electrics. Prior to 2018, ZEV mandates could be satisfied with a near handful of all-electric vehicles, plus varying credits for some others, including straight hybrids-- called Advanced Technology Partial Zero Emission Vehicles (AT PZEV), plug-ins (PHEV, in pre-2018 period also called Enhanced Technology AT PZEV) and basic non-hybrid PZEVs.

The basic PZEV had no effect on GHG, but it satisfied California’s SULEV (Super Ultra-Low Emission Vehicle) regulation which required a car be 90% lower in emissions (hydrocarbons, carbon monoxide, nitrogen oxide and particulates) than the average of conventional vehicles. PZEV includes engine and catalyst system modifications and zero evaporative emissions, using a canister vent trap, a carbon vent at the engine inlet and improved sealing. It carries a 15 year/150,000-mi emissions warranty, and has specific on-board diagnostics.

PZEVs and AT PZEVs credits ended completely in 2017, but leftovers can be “banked” for 2018-on use. However, they’re deeply “devalued,” to 25% for intermediate-size OEMs, to just 6.75% for large makers.

New category - TZEV

The Enhanced Technology AT PZEV meant it met SULEV and had a minimum PHEV 10-mi all-electric range. Along with the hydrogen-fueled internal combustion engine (ICE with a 250-mi range or greater on the EPA city cycle, or “UDDS”). It’s in a new category called TZEV (“Transitional PZEV”) and qualifies for 2018-on credits. UDDS range, where used (as for a vehicle’s all-electric range), generally is at least 30% greater than the vehicle label number. There’s also a 0.2 TZEV credit bonus for greater than 10 mi all-electric range on the US06 (heavy acceleration) cycle.

Engineers know that nothing in a government regulation is ever truly simple. Only the following vehicle types are eligible for ZEV credits from 2018-on: (1) a true BEV, with its numerical credit (capped at 4.0) based on rated UDDS range; (2) a fuel cell vehicle; 3) the as-noted “TZEV,” (4) neighborhood electric vehicle as used in adult communities, with top speeds in the 20-25 mph range (eligible for a modest credit).

Finally there’s one we’ll likely be seeing a lot of: the “BEVx,” a battery electric vehicle with a minimum 75 mi all-electric range that includes a SULEV-certified combustion engine and a fuel tank that extends range to no more than the all-electric.

BMW’s I3 electric, for example, has a range of 114-mi on batteries, and a $3850 range extender engine/generator option, which with a 1.9-gal tank increases total range to 180 mi. Its twin-cylinder 650-cc scooter engine engages to recharge the battery pack, maintaining its level at about 30%.

Fuel cell vehicles are in the same category as BEVs, and can earn similar credits. Internal combustion engines that run on hydrogen and have a range of at least 250 mi (UDDS) start with a 0.75 ZEV credit, but can earn up to 0.5 more with what is called a VMT (Vehicle Miles Traveled) allowance. This is based on a formula originated for parallel hybrid PHEVs, to determine an “equivalent all-electric range” (EAER).

The 2018 mandate specifies a large OEM deposit ZEV credits equal to 4.5% of its sales in 2018, although 2.5 of the 4.5 (55%) can be met with TZEV credits. The total requirement rises by 2.5 percentage points per year, with the TZEV number increasing by 0.5. Intermediate-size makers can fulfill all ZEV requirements with TZEV credits, an obviously helpful break.

Further, ZEV credits accumulated prior to 2018 can be banked, but ZEV shortfalls can't be covered with CAFE credits. Indeed Fiat Chrysler has stored 90,722 credits (mostly purchased from Tesla, according to industry sources) to cover its fleet miles-per-gallon deficiencies. Although it has sold an unspecified number of Fiat 500e BEVs in California and Oregon since 2013, the sales have been reportedly modest. The Pacifica minivan PHEV could provide some TZEV credits.

Contrast with 2009-17 regulations

The new rules contrast with the 2009-17 regulations, which put makers with up to 60,000 California sales in the intermediate category, allowed them to meet ZEV requirements with PZEVs, and set large manufacturers with a rising ZEV scale that hit 14% for the 2015-17 period. However, only 3.0% had to be actual ZEV (3000 credits on California sales of 100,000, or 750 vehicles with a credit rating of 4.0).

The reduction from 60,000 to 20,000 unit sales was the result of rulemaking evaluations and consideration of worldwide sales. Previously (2008-2010 averages) only General Motors, Fiat Chrysler, Ford, Nissan, Toyota and Honda were in the California “large” category.

Each ZEV carried an all-electric range multiple starting at 2.0 for 50 mi. The rest could be generated with credits from PZEVs, hybrids (AT PZEVs), and Enhanced AT PZEVs. There was an additional allowance for PZEVs that ran on hydrogen or CNG. Other special allowances, covered PHEVs with a range of equal or greater than 10 mi, and vehicles with “advanced componentry,” such as regenerative braking and idle stop/restart.

For years the industry relied on ZEV sales in California, where they are heavily advertised, the climate is more favorable and there is some charging infrastructure in place. Sales “traveled,” meaning were proportionally applicable to all the ZEV/Section 177 (mostly Northeastern and Oregon) states. Companies without a BEV program could buy credits, as from Tesla.

With the 2018 mandate, only non-California fuel cells “travel” and if they “cross the country” (sold in Oregon, also credited to New Jersey), there’s a 30% credit fee (130 for 100 credits).

Overcompliance a new path that reduces ZEV mandate

In addition to banked ZEV credits, which can be used through to 2025 as needed, there is “GHG-ZEV overcompliance.” An OEM can propose to surpass its fleet average standard by at least 2.0 g CO2 target value (based on model type and vehicle footprint), on UDDS, the EPA Federal Test Protocol City CO2 g/mi (55% ) and EPA Highway Fuel Economy Test (45%). A maker’s ZEVs must be included in the target value calculation.

Although projected data is not available, CARB has estimated some 10-20% of California sales would go for the overcompliance credits. They’re limited to the model year in which they’re earned, can only be used by the earning manufacturer (no trades). There’s a 50% cap on their use for the 2018 and 2019 ZEV mandate, and the cap drops to 40% for 2020 and 30% for 2021.

Another compliance path–penalty-free pooling--also was instituted to encourage ZEV sales in the ZEV/Section 177 states, wherever demand might be stimulated. Increasing sales in the northeast clearly is difficult because most of these states face cold winters and the problem of range reduction from vehicle heating. Without mitigation from specific engineering, such as vehicle pre-heating, range extender engines, heat pumps and perhaps heat storage, ZEVs are likely a hard sell.

If an automaker misses its ZEV requirement, the deficit must be made up by the next model year, using only ZEV credits. Intermediate-size makers may be given up to three years, and use both ZEV and TZEV credits. Failure subjects a carmaker to a $5000 per credit shortfall penalty.

Author: Paul Weissler

Source: SAE Automotive Engineering Magazine

等级

打分

- 2分

- 4分

- 6分

- 8分

- 10分

平均分