Aqua Metals 的Lithium AquaRefining试点项目的工厂内部。(Aqua Metals)

Aqua Metals 的Lithium AquaRefining试点项目的工厂内部。(Aqua Metals) ReCell应用材料部材料回收小组负责人Jeff Spangenberger

ReCell应用材料部材料回收小组负责人Jeff Spangenberger 直接再循环技术通过几个步骤对电池进行处理,所有步骤都在温和的条件下进行,以回收适合用于生产新电池的材料 晶体结构完好的阴极是主要目标,但也在寻找阳极碳和电解质盐。(ReCell)

直接再循环技术通过几个步骤对电池进行处理,所有步骤都在温和的条件下进行,以回收适合用于生产新电池的材料 晶体结构完好的阴极是主要目标,但也在寻找阳极碳和电解质盐。(ReCell) 直接再循环回收的活性材料可直接用于制造新电池,避免了昂贵和能源密集型的加工步骤。(ReCell)

直接再循环回收的活性材料可直接用于制造新电池,避免了昂贵和能源密集型的加工步骤。(ReCell) Factorial Energy的联合创始人兼首席执行官黄思宇

Factorial Energy的联合创始人兼首席执行官黄思宇 Factorial 的 FEST(Factorial 电解质系统技术)100+ Ah 准固态电池电池。(Factorial)

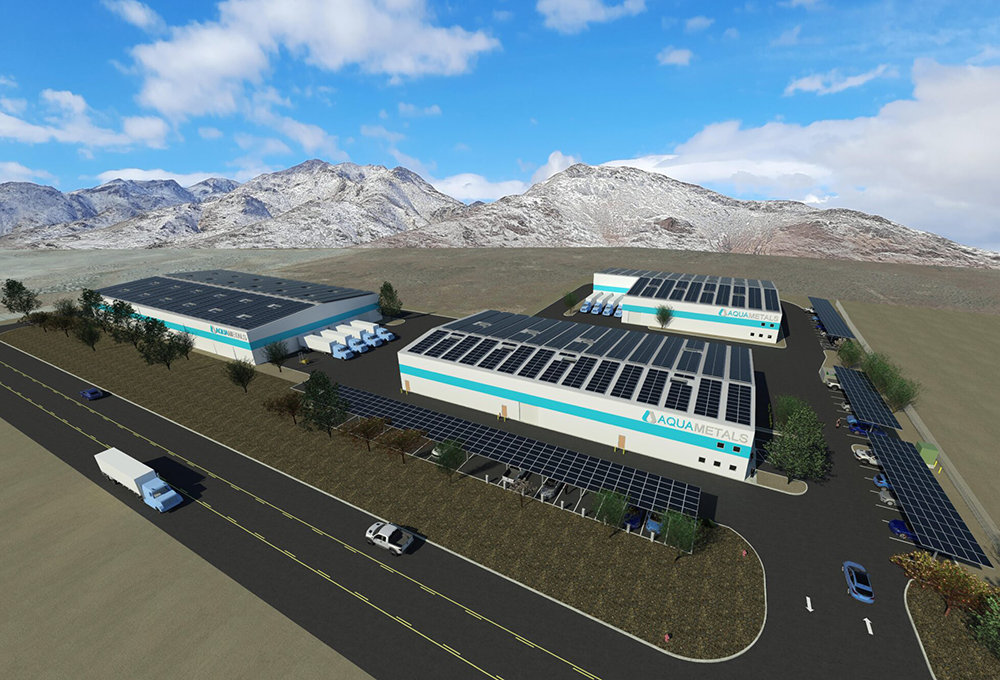

Factorial 的 FEST(Factorial 电解质系统技术)100+ Ah 准固态电池电池。(Factorial) Aqua Metals公司未来的Sierra ARC园区效果图。公司表示,分阶段发展战略将使 Aqua Metals 公司 "迅速扩大我们的商业锂电池回收能力,同时保持更高水平的灵活性和适应性"。(Aqua Metals)

Aqua Metals公司未来的Sierra ARC园区效果图。公司表示,分阶段发展战略将使 Aqua Metals 公司 "迅速扩大我们的商业锂电池回收能力,同时保持更高水平的灵活性和适应性"。(Aqua Metals) 用过的袋式电池经粉碎后可产生多种产品。黑色粉末含有阳极碳和有价值的阴极材料。(ReCell)

用过的袋式电池经粉碎后可产生多种产品。黑色粉末含有阳极碳和有价值的阴极材料。(ReCell)

为了处置市场上将出现的大量废旧电动车电池,已有多家公司开始着手研究电池回收技术。

回收电动车电池是汽车行业多年以来的目标,但由于基础设施薄弱,电池回收技术的大规模落地仍处于早期阶段。随着电动车产生的废旧锂离子电池和电芯不断增加,汽车行业也做好了将其回收再利用的准备。

美国联邦政府推出了促进锂离子电池回收的举措,而这不止是为了减少电池对环境的影响。废旧电池材料不仅能用于制造新电池,也有助于将电动车电池的生产成本降低至60美元/kWh的国家目标。

2019年2月,美国能源部(DOE)汽车技术办公室(VTO)启动了ReCell中心,携手行业、学术界和国家实验室共同研发针对当前和未来电池材料体系的回收技术。ReCell中心由阿贡国家实验室、国家可再生能源实验室(NREL)、橡树岭国家实验室以及爱达荷国家实验室联合四所高校共同组建。

ReCell应用材料部材料回收小组负责人Jeff Spangenberger告诉SAE,ReCell不仅关注电池回收的科学问题,还致力于推动行业的协作发展。

Spangenberger表示:“电池回收是降低材料成本的绝佳途径。从回收材料或电池原料中直接提取所需材料要比开采矿物容易得多,为此需要行业的共同努力。没有人能够单枪匹马地解决这一问题,所以我们致力于促进行业机构间的合作。”ReCell会定期举办行业合作会议,以促进各方合作交流。

ReCell重点研究电池直接回收技术。目前电池回收主要依靠湿法冶金和火法冶金两种技术,即利用化学反应或热量将电池分解为金属硫酸盐等原料化合物。而直接回收技术则有所不同,可以在不分解电池化学结构的情况下,实现电池成分的回收再利用。ReCell官网称其开发出了一种名为EverBatt的分析模型,该模型“可比较原始电池与再生电池的影响和工艺,并确定其对不同参数的敏感性”。利用该模型研究发现,直接回收技术比湿法冶金和火法冶金技术耗能更少,更可持续。

“我们刚开始探索直接回收技术时,市场上只有一家公司在从事相关研究。但随着我们不断取得突破,我们希望带动整个行业蓬勃发展。目前,市场上已有大约三家公司在从事相关研究,并已达到试点规模。这表明,投资者已经关注到了直接回收技术,并愿意投资。”

总部位于马萨诸塞州沃本市的美国初创公司Factorial Energy正在研发未来电动车的半固态电池技术,并已开始探索报废电池的回收方式。2023年6月,Factorial Energy宣布将与韩国财团永丰集团合作打造电池回收业务。

她认为:“拆卸固态电池本身就比拆卸锂离子电池更安全。这是因为固态电池的固体电解质比液体电解质多。其次,由于回收锂金属阳极可能比回收碳或硅阳极价值更高,因此固态电池的再生价值可能也更高。”

美国本地的电池生产和应用也获得了联邦政府的投资。拜登总统于2022年8月通过的《通货膨胀削减法案》(IRA)除了为2300家电网级电池工厂提供资金外,还包括广为人知的电动车税收抵免政策,单辆汽车最高可达7500美元。IRA对国产电池的强调也将重塑电动车电池的产地和原材料来源。

Regan说:“回收1万吨原料对我们来说完全不是问题。有很多黑色物质生产商正在和我们洽淡,剩下的只是定价问题。此外,我们也在同OEM和电池制造商合作。到2030年,这些公司的电池制造产能将达到1TW,这将产生大量的制造废料,但OEM并不想将其浪费。于是,他们已经开始投资相关技术,希望将这些废料进行循环利用。”

Regan表示:“传统工艺产生的废料污染极其严重,碳排放量也很高。但我们的工艺不会产生任何硫酸钠。此外,我们使用的是可再生电力,因而产生的碳足迹也远低于其它技术。假设使用传统工艺回收黑色物质,每回收1吨就会产生2吨硫酸钠废料,那么这些废料必将进入填埋场或流入海洋。如果回收了数百万块锂离子电池和电动车电池,那么几十年后将会产生数百万吨废物,这是非常不可持续的。”

Recycling electric vehicle batteries has been a goal of the auto industry for many years, but the infrastructure to make that a widespread reality is still in the early stages. As the amount of used lithium-ion batteries and cells coming from EVs increases, the industry is getting ready to turn them into fresh packs.

In the U.S., the federal government’s push to recycle more li-ion batteries isn’t just to reduce environmental impact. Salvaged materials can be used in new batteries, and recycling can help get the overall production cost of EV batteries under the national goal of $60/kWh.

In February 2019, the U.S. Department of Energy’s (DOE) Vehicle Technologies Office (VTO) launched the ReCell Center, bringing together industry, academia, and national laboratories to develop battery recycling technologies for current and future battery chemistries. ReCell is a collaboration of four national laboratories – Argonne, the National Renewable Energy Lab (NREL), Oak Ridge and Idaho National Laboratory – and four partner universities.

Jeff Spangenberger, ReCell’s materials recycling group leader in the Applied Materials Division, told SAE Media that ReCell focuses not just on the science of recycling batteries, but also on the people working on this technology.

“Battery recycling is a great way to reduce the material costs,” Spangenberger said. “It’s a lot easier to recover the materials from recycled materials or from the feedstock of batteries than from the ground. To do that, we like to connect people. No one person is going to solve this, and so we try and connect the dots.”

ReCell hosts industry collaboration meetings for those dots, with the next event happening in mid-May.

DIrect recycling at ReCell

ReCell’s research is focused on direct recycling. Unlike existing hydro- or pyro-metallurgical recycling methods that use chemicals or heat to break down a battery into feedstock compounds like metal sulfates, direct recycling recovers or reuses components in the battery without breaking down the chemical structure. ReCell’s website says itdeveloped an analysis model called EverBatt to “compare impacts of virgin batteries to those with recycled content, to compare processes, and to identify sensitivities to various parameters,” and found that direct recycling promises to use less energy and is more sustainable than hydro- or pyro-recycling.

“[Direct recycling is] not really researched, it’s not commercial,” Spangenberger said. “But the analysis says that direct recycling is a huge opportunity to really catapult the industry into a cost-effective, profitable endeavor, and that would be over hydro and pyro.”

Spangenberger said ReCell has around 50 projects it’s working on, with about half of them focused on direct recycling.

“When we started this, there was one company that was working on direct recycling and as we break down the barriers, we want industry to take off,” he said. “Now, there’s about three companies that are working on this up to the pilot scale. That’s showing that we’re getting people interested and funding is flowing into direct recycling.”

ReCell’s other projects focus on advanced resource recovery (finding another home for components, perhaps being upcycled into a new product), design for sustainability (designing batteries so they’re easier to recycle or demanufacture) and modeling and analysis (like EverBatt), which Spangenberger said allows ReCell to focus on projects that make big-picture sense. These four aspects obviously interact with each other. Designing something for sustainability means considering if a chemical added to a battery for better performance could obviate its recycling capability, for example.

“You can’t have [design for sustainability] as the first metric in the design of a product,” Spangenberger said. “If you can’t sell a product, you don’t need to worry about recycling. So, the cost has to be right, performance has to be right. But I think that one of the metrics that has to be included is end-of-life management. And that’s true for any product.”

Hexagon’s digital twins to the rescue

Global digital reality solutions company Hexagon uses digital twins to help companies manufacture their products better. Hexagon’s director of automotive, George Cuff, told SAE Media that digital twin technology can be used with EV batteries to analyze how they function in the real world, like their various thermal characteristics.

“That information can be captured and we can drive that back into product development,” he said. “We’ve got a variety of different tools in the simulation space. As they’re trying to optimize the design, they run through a variety of different scenarios, using that real-world information to help drive that.”

Cuff said digital twins could also be used to better recycle batteries. Hexagon’s software can manage various materials in the digital twin for simulation analysis, for example.

“[That data] can also provide the ability to analyze and say, for this particular battery or this particular vehicle, we have X amount of these raw materials,” he said. “This can be recycled, this percentage is hazardous material waste. I can absolutely see a scenario where governments are going to regulate or require an understanding of the types of materials, what can be recycled in these battery packs, what can’t be, and what would ultimately be hazardous materials. When these batteries and battery packs really come to end of life there, we’re going to need to have a good solid plan to be able to handle them.”

Officially, the EPA recommends that businesses manage used lithium batteries as hazardous waste, which means the batteries need to be sent to a permitted hazardous waste disposal facility or a hazardous waste recycler as their final destination. If these waste batteries are being shipped internationally, they need to comply with RCRA requirements for the export and import of universal waste. Domestically, the Department of Transportation regulations for shipping lithium batteries apply as well to shipping lithium batteries as hazardous waste, even though the EPA says EV batteries that are removed at “a dealership, an auto shop, a scrap yard, or similar type of facility” are not considered household hazardous waste.

Solid-state is easier

Woburn, Massachusetts-based Factorial Energy is developing quasi-solid-state batteries for future EVs, and is already working on how to recycle them at end-of-life. In June 2023, Factorial announced it would work with the South Korean chaebol (conglomerate) Young Poong to build out recycling capabilities.

“There are quite a few recycling companies in the U.S., but most of them have been focused on lithium-ion,” Factorial co-founder and CEO Siyu Huang told SAE Media.”At the time, Young Poong was the only one that we knew was working on lithium metal recycling, and the process is quite different from lithium ion. [This] can help us reduce the cost of the cell in the future because we are a cell maker, and there are always cells coming out of the scrap and there are end-of-life cells and from our customers, so it’s good to have value generated at end of the life.”

Huang said solid-state batteries, if they ever gain widespread acceptance in EVs, will be easier to recycle than today’s li-ion packs.

“Solid state is, by nature, safer for disassembly compared to lithium-ion,” she said. “It has more solid than liquid. Potentially, it also has better regenerative value, too, because recycling lithium metal as the anode is probably going to be more valuable than recycling carbon or silicon in the anode.”

Currently, Factorial needs to ship components to be recycled to Young Poong facilities in South Korea, but is “actively looking for local suppliers that can do recycling in North America,” Huang said. “A lot of them are interested. It’s just a matter of time and commitment to build a technology that’s viable for recycling for lithium metal. Not everyone is as advanced as they are in Korea. But, if there is enough interest and also enough support from the government from various regulatory pathways, I think they’ll definitely bring a good tailwind to such industry investment.”

Watch your waste stream

There’s no lack of federal money headed toward domestic battery production and use. President Biden’s Inflation Reduction Act (IRA), passed in August 2022, included money for 2,300 grid-scale battery plants along with the better-known electric vehicle tax credits worth up to $7,500. But the IRA’s emphasis on domestic production is also reshaping where EV batteries will be made and where the mterials will come from.

Aqua Metals has been running a pilot of its closed-loop metal recycling process for a little over a year. David Regan, vice president of commercial at Aqua Metals, told SAE Media that work is progressing on its Sierra ARC (AquaRefining Campus) processing center in the Tahoe-Reno Industrial Center. Aqua Metals said the ARC,“ will be the first sustainable lithium battery recycling center in North America and the first commercial-scale deployment of our Li AquaRefining technology.” Regan said the equipment was being installed this spring, and he expects black mass to be going in over the summer. The ARC should be in full production by the end of the year, he said, and Aqua Metals has a target of processing 3,000 tons of black mass in the first phase, with 10,000 tons as the target for the next phase.

“We don’t see any issues getting feedstock for ourselves at up to 10,000 tons, at all,” he said. “We’re talking to a lot of black mass creators. It’s just really a matter of pricing. We’re also engaged with OEMs and cell manufacturers. Between now and 2030, they’re going to scale to a terawatt of cell manufacturing by 2030. That’s going to produce a significant amount of manufacturing scrap. They don’t want that to go to waste. The OEMs have spent money on that material, and they want to get it back into circulation.”

In March 2024, Aqua Metals and 6K Energy announced they would jointly develop a sustainable lithium battery circular supply chain in North America. Regan said 6K’s process uses nitrates instead of sulfates as a feedstock. 6K doesn’t produce any sodium sulfate waste stream as part of its process, whereas traditional cathode active material (CAM) manufacturing produces around 26 tons of sodium sulfate for every ton of CAM, Regan said. Traditional hydro-recycling also produces about one-and-a-half to two tonnes of sodium sulfate for every ton of black mass, he said.

“Traditional processes are extremely dirty when it comes to waste streams, and also have a high carbon impact,” Regan said. “We don’t produce any sodium sulfate. Using renewable electricity, we have an extremely low carbon footprint compared to other technologies. If we’re producing two tons of sodium sulfate for every ton of black mass recycled, that has to go into landfill or go into the ocean. When we’re recycling millions of lithium-ion batteries, EV batteries, millions of tons eventually, over the decades, that amount of waste stream is just not viable.

等级

打分

- 2分

- 4分

- 6分

- 8分

- 10分

平均分