如今,汽车雷达传感器市场正在以每年 21% 的复合增长率飞速扩张,创造了大量芯片设计、测试和模块部署方面的需求。

长久以来,多家汽车制造商一直奋力拼搏,只为能在 2020 年将首辆自动驾驶汽车投放至公共道路。但 2020 年以来,汽车行业对全自动驾驶汽车的态度却从绝对乐观转为谨慎看好。目前,尽管汽车行业距离实现真正的全自动驾驶汽车(即没有方向盘的自动驾驶汽车)还有至少数年时间,但用于支持这些智能自动驾驶汽车工作的相关技术与创新却一直层出不穷。

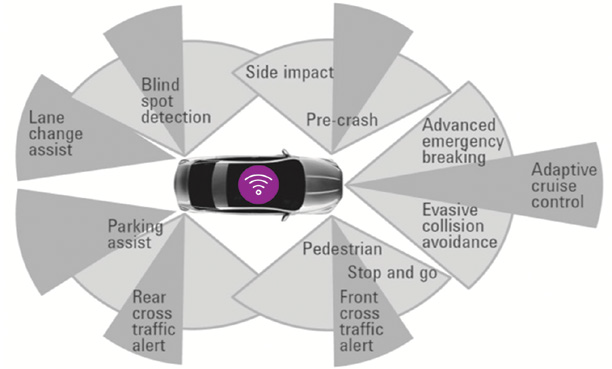

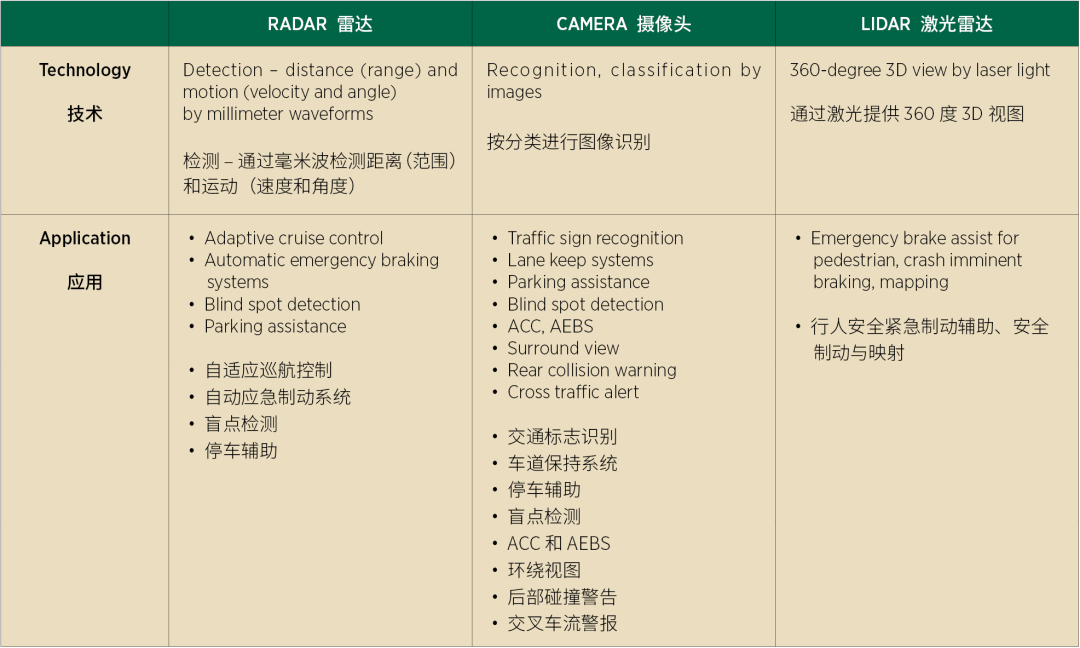

如今,越来越多的汽车均需要通过传感器技术与其他车载设备和周边环境相连接。在此背景下,汽车开发人员面临的安全标准合规压力越来越大。现阶段,汽车行业可以选择的传感器类型日益丰富,性能也越来越强大(见下表)。其中,汽车雷达已经成为保证汽车高级驾驶辅助系统(ADAS)正常工作的重要使能技术之一。

大约 10 年前,24 GHz 雷达传感器开始进入工程人员的视线,并在一定程度上使能了一批全天候 ADAS 功能,如盲点检测、车道变换、停车辅助以及碰撞避免等。与摄像头技术相比,雷达技术受光照条件或恶劣天气的影响更小,因此很快获得了 ADAS 应用的青睐。

汽车雷达可以扫描三维空间,并收集有关其他道路用户和静态物体的信息,包括识别其他车辆、行人和宠物的存在,以及收集这些目标的位置、速度、方向、形状和身份等细节信息。在大多数应用场景中,雷达系统可以通过天线向目标位置发射射频/ 微波或毫米波信号,并使用同一天线接收返回的信号。

接着,反馈信号将触发车辆的电子控制单元,并激活相应的 ADAS 响应,比如发出车辆变道提示、进行脆弱道路用户预警或激活车辆的自适应巡航控制以帮助驾驶员保持安全车距等。

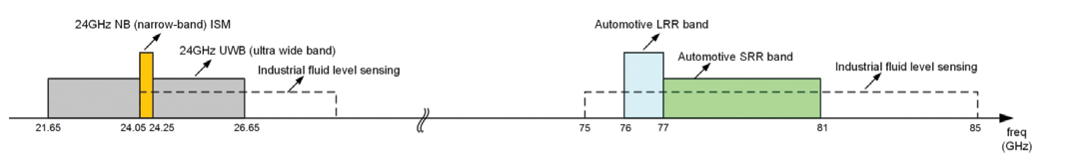

根据欧洲电信标准协会(ETSI)和美国联邦通信委员会(FCC)的频谱法规,自 2022 年 1 月 1 日起,新的汽车雷达设备将不得继续使用 24 GHz 频段和 UWB 频段。

受此规定影响,76 GHz 至 81GHz 汽车雷达市场正在迅速扩大。该频段允许设计人员缩小传感器的封装尺寸,并通过提高带宽来提高检测目标的分辨率。

如今,汽车雷达传感器市场正在以每年 21% 的复合增长率迅速扩张。根据《微波杂志》(Microwave Journal)的数据,到 2023 年,汽车雷达市场的规模预计将超过 80 亿美元,领先雷达技术在环境监测、安全监控、航空航天及国防科技等其他领域的应用。为了保证汽车雷达市场的稳步增长,雷达的性能和可靠性至关重要。

如今,一辆自动驾驶汽车最多可以装载 24 个雷达传感器。这些雷达传感器相互之间,包括与其他车载设备之间,均可能会产生干扰效应。然而,考虑到汽车行业的特殊性质,雷达行业在汽车领域的应用决不允许任何误差。例如,在一个繁忙的十字路口,如果雷达提供的信息哪怕存在一点点误差,也可能导致十分严重的后果。因此,每一款雷达模块在量产和真正应用至汽车产品之前都必须经历非常严格的测试。如今,工程师通常会使用雷达仿真设备生成和分析不同的信号,并使用软件针对各种一致性测试标准创建测试用例,从而摸清雷达模块在各种环境下的性能与特点。

可以想象,每一款雷达在真正上市前均需要经历成千上万次测试。因此,一些测试经理还会使用智能实验室操作软件进行被测设备(DUT)的系统化测试管理,从而更好地帮助他们更准确的判断产品原型是否已经可以进行大规模生产。在功能测试层面,工程师现在已经可以为 76 GHz - 81 GHz 雷达模拟多个检测目标,从而允许雷达模块开发人员和汽车制造商能够在真实道路测试之前,在安全的虚拟环境中模拟大量现实场景。

从另一方面讲,雷达技术的探测分辨率仍需提高,这样才能更好的分辨目标。激光雷达在这方面的性能明显更好。激光雷达传感器使用脉冲激光检测对象,通常具有比雷达更高的分辨率,而且探测的颗粒度更细,因此可以提供更完整的车辆环境视图。

然而,与摄像头和雷达传感器技术相比,激光雷达通常更昂贵。目前,一些行业新秀正试图推出更便宜的激光雷达,最低报价甚至可以不到 1,000 美元。不过,激光雷达的常规价位仍还在 10,000 美元左右徘徊。此外,激光雷达还面临数据速率高、工作功耗大,以及低照明条件下的性能较差等种种限制。未来是否会出现一些新的颠覆性技术能大幅降低激光雷达的成本,进而推广其在汽车领域的广泛应用呢?让我们拭目以待吧!

The automotive radar sensor market is growing at a 21% compound annual growth rate, putting greater demands on chip design, testing, and module deployment.

Until recently, various vehicle OEMs were vying to be first to put self-driving cars on the road by the magical turn of the decade. But as 2020 arrived, the bullish tone has switched to a more cautionary outlook. While the truly self-driving SAE Level 5 autonomous vehicle (AV) without a steering wheel is still years away, innovations needed to support the intelligent self-driving car of the future continue to emerge and improve.

Developers grapple with the need to comply with safety and security standards as the average car sees more sensor technology connecting it with onboard devices as well as with its environment. Within the increasingly capable sensor suite (see table), automotive radar is now an indispensable technology that enables sub-systems for advanced driver assistance systems (ADAS).

About a decade ago, 24-GHz radar sensors entered the scene and began to impress engineers, enabling all-weather ADAS functionality such as blind spot detection, lane change and parking assistance, and collision avoidance. Minimally affected by lighting conditions or bad weather, radar quickly gained favor over camera technology for ADAS applications.

Radars evolve and proliferate

The essence of automotive radar is the ability to scan the three-dimensional space and gather information about other road users and stationery objects. This includes picking up the presence of other vehicles or pedestrians and pets, to details such as location, speed, direction, shape, and identity. In most implementations, the radar system generates a RF/microwave or millimeter-wave signal and beams it toward the target in question.

The same antenna that transmitted the signal, collects the feedback. The feedback triggers the electronic control units on board the car to activate the appropriate ADAS response. This can be a lane change or vulnerable road user alert, or a trigger to activate adaptive cruise control to help drivers maintain safe platooning distance.

Due to spectrum regulations by the European Telecommunications Standards Institute (ETSI) and the Federal Communications Commission (FCC), the 24-GHz-wide bandwidth and UWB bandwidth will not be available for new automotive radar devices after January 1, 2022.

These changes are spurring market growth for 76-81-GHz band usage for automotive radar applications. These higher frequency bands allow designers to create smaller sensor packages, with more bandwidth available to achieve greater resolution of detected objects.

The automotive radar sensor market is growing at a compound annual growth rate of 21%. By 2023, it is expected to exceed $8 billion, according to Microwave Journal, outstripping other radar sectors like environmental monitoring, security surveillance, and aerospace defense. Meeting this market growth without compromising on performance and reliability requires rigorous testing of each radar from chip design to module deployment.

A self-driving car can have up to 24 radar sensors. Interference effects can arise between sensors within the same car or with other onboard devices. Even marginal errors in measurement, such as wrong angle calculation at a busy road junction, can result in dire consequences. Therefore, engineers must characterize the behavior of each new radar module before mass production and installation in the vehicle. These days, engineers use radar emulation equipment to generate and analyze different signals, with software to create test cases for different conformance test standards.

Some test managers also use intelligent laboratory operations software to help them manage the thousands of tests for their devices under test (DUT). This can help them precisely determine prototype DUT readiness for mass production. At the functional test level, engineers can now simulate multiple targets for radars operating in the 76-81-GHz band. This allows both the radar module developers and car makers to test a multitude of realistic scenarios before the car rolls onto real roads.

Current radar technology still struggles with providing greater resolution to discern different objects. This is where lidar does a better job. A lidar sensor uses a pulsed laser to detect objects, usually with higher resolution than radar. Lidar’s higher degree of granularity can provide a much more complete view of the vehicle’s environment.

On the downside, lidar is generally more expensive versus camera and radar sensor technology. New players are trying to produce cheaper lidar, with some innovations going for under $1,000, versus typical prices in the ~$10,000 range. Lidar has other limitations including high data rate and power consumption, and poorer performance in low lighting. It will be interesting to see if new disruptive technologies help make lidar cheaper and better for wider adoption.

SAE Autonomous Vehicle Engineering

随着汽车行业向SAE L5 级自动驾驶汽车稳步迈进,传感器测试方面的挑战也日益凸显。

随着汽车行业向SAE L5 级自动驾驶汽车稳步迈进,传感器测试方面的挑战也日益凸显。

24 GHz 和 77 GHz 频段雷达在汽车领域的应用。

24 GHz 和 77 GHz 频段雷达在汽车领域的应用。