2019 款雪佛兰Silverado 皮卡的驾驶舱是多种钢材和铝材混合应用的典范。

2019 款雪佛兰Silverado 皮卡的驾驶舱是多种钢材和铝材混合应用的典范。

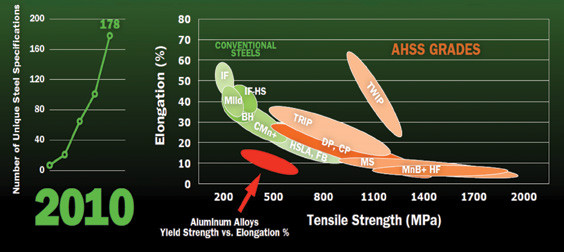

过去十年中,先进高强度钢种家族出现了很多强度更高的新成员。

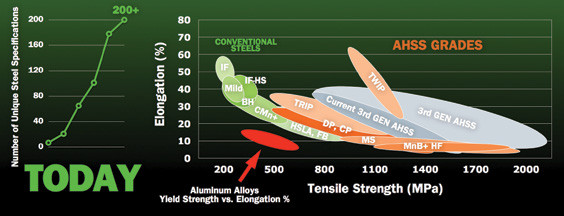

过去十年中,先进高强度钢种家族出现了很多强度更高的新成员。 2019款本田讴歌的后方双环负载传递路径架构主要采用了钢材,RDX 的门环则采用了 1500 MPa AHSS 高强度钢。

2019款本田讴歌的后方双环负载传递路径架构主要采用了钢材,RDX 的门环则采用了 1500 MPa AHSS 高强度钢。

凭借持续创新和协作开发模式,钢铁作为交通行业的“主力”材料,地位仍不易撼动。

by Lindsay Brooke

2014 年,福特(Ford)隆重推出 F-150 铝质皮卡,整个汽车行业为之一震。在这之前不久,Ducker Worldwide 也曾发布了一项针对国际铝业的研究,预测这种轻质金属材料将在下一个新车开发周期中在北美轻型卡车细分领域中占据主导地位,并表示届时近七成新皮卡均将大量采用铝材料。多重信号似乎均表明,一场铝业革命正在汽车行业中酝酿。

然而,事情并未向预计的方向发展。五年过去了,全球市场中仍没有任何一辆量产皮卡真正在驾驶室和底盘等主要位置大量采用铝材。这种趋势在全球主流车厂的新车发布中可见一斑:福特为全新 2018 款全尺寸 SUV 配备了铝质车身结构,但 2019 款福特 Ranger 的主要架构仍是钢材;通用汽车 (GeneralMotors) 2019 款雪佛兰(Chevrolet)、GMCSilverado、Sierra 1500 及一些高配车型均毫无例外地延续了公司专为皮卡和 SUV 车型打造的“混合材料战略”;FCA 集团旗下的 Ram 和 Jeep 品牌卡车也继续采用钢结构。不过,新款 JL 系列 Jeep 牧马人则改用铝质车门(和铰链)、发动机罩、挡泥板和挡风玻璃架(尽管仍不涉及驾驶室和底盘等主要位置),具体铝材型号包括美铝(Alcoa)新型 C6A1 高合金、6022 号合金和 A951 号合金。

事实上,牧马人可以成功减重 200 磅(91 公斤)的一个原因,是采用了镁材料的后摆门,也就是说FCA 为牧马人重新启用了 Pacifica 休旅车搭配的镁材料升降门(成本并不低)。此外,这些卡车还有一个共同点,即全部采用了钢质梯形框架搭配部分铝质横梁的设计,这也同时体现了经过有限元方法优化的高强度钢材的极致性能。

对此,密歇根大学材料科学与工程系教授 Alan Taub 博士观察到:“我们已经从‘密集使用单一材料’的传统材料观转变为‘将合适的材料,用合适的方法,应用至合适的位置’的新思路。”

对此,初创公司 Rivian 的创新 R1T 电动皮卡就是一个很好的例子。据了解,这款电动皮卡预计将于2021 年问世,其主驾驶室经过专门设计,采用了多种高强度钢材搭配铝质封装的设计,可显著降低重量并优化防撞性能。

事实上,除了一些经济型车型,这种混合材料应用的思路也得到了众多豪车制造商的认可。几个例子:特斯拉 Model3 和Model Y 均未延续 Model S 和 Model X 密集使用铝制材料的设计,反而应用了相当大比例的钢材;奥迪(Audi)也不再一味推广“铝材料”战略,转而向“混合材料”的设计思路转型(包括公司最新的 eTron 电动车也是如此),而这种转型在汽车行业中并不少见。

钢铁市场发展研究所(Steel Market Development Institute)汽车市场副总裁Jody Hall 博士表示,“如今,一提到’汽车减重’,大环境追求的已经不再是’密集使用铝材料’,而是’灵活采用多种材料组合’ ——这就是汽车厂商向我们传达的信息。”此外,Hall 和 Taub 博士均认为,首先,钢材较其他轻金属和碳复合材料拥有得天独厚的优势;其次,钢铁行业近年来也在积极研发更加结实的汽车专用钢材。在此背景下,钢材作为汽车车身结构和底盘系统“主力”材料的地位无法撼动,至少未来十年的情况不会变化。

此外,我们也可以从图片上看到,近些年来,强度更大、延展率更高的钢种层出不穷,从大约 200 MPa到2000 MPa 不等,选择范围远远超过其他任何一种单一金属材料。“要想获得与新型钢材类似的强度范围,你只能选择增强复合材料。”Hall 博士断言,“但增强复合材料的成本却是其他基础材料的很多倍。事实上,从性价比来说,没有任何满足汽车行业要求的其他材料能够与钢材媲美。”

“第三代”材料闪电战

对很多开发工程师而言,钢材行业的吸引力在于这个行业不断推陈出新的创新合作模式。事实上,这种合作创新始于 20 世纪 80 年代,当时的钢铁制造商不得不联合抵御塑料行业对汽车皮革的冲击。“我们的合作是与整个钢铁行业展开的,而非某一家钢铁公司。”Hall 博士解释说:“钢铁行业向我们展示他们的设计,而我们的作用是帮助他们以更具成本效益的方式让这些设计成为现实。”

“当然,这并不是说钢铁公司不会单独与汽车制造商合作以满足它们的特殊需求,只是说整个行业的广泛参与已经得到了汽车客户的肯定,”Hall 博士表示,“我们都希望利用更少的资源,完成更大的目标。因此,从调配资源和保证时效方面,行业合作是一种非常有效的方式。几十年来,我们一直坚持这种工作方式,并从中持续受益。”

目前,市面上最先进的高强度(AHSS)和超高强度(UHSS)钢种可以提供 2000 MPa 的拉伸性能。这种所谓的“第三代”高强度钢在 2018 年正式问世,主要供应商包括 ArcelorMittal、AK Steel 和 Nucor。事实上,当时,有一些原始设备制造商需要一种在保证同等强度的前提下,延展性更高的钢材,第三代钢种应运而生。

“厂商这么要求部分是希望减少冲压硬化钢的用量。”Hall 博士解释说,“具体来说,他们希望可以在不升级生产设施的前提下,在室温环境将钢材加工为一些几何形状更为复杂的零部件,这是目前的高强度钢种无法满足的。这些厂商希望降低冲压生产线的成本。”

任何新材料在进入汽车行业前均需等待一定的验证和交付时间,因此第三代钢种在汽车行业的大规模应用预计将在 2023 年左右实现。专家指出,在未来,冲压硬化钢将允许车身工程师在保证高强度的前提下,打造几何形状更为复杂的零部件,因此并不会从汽车行业退出历史舞台。举个例子,本田(Honda)已将这种冲压硬化钢应用至旗下 NSX 超级跑车的 A 柱中,从而最大限度地缩小 A 柱的横截面,为驾驶员提供不受遮挡的开阔视野。此外,RDX 车型的内外门环中也采用了 1500-MPa 钢。

在保证同等强度的前提下,铝合金零部件的成形更加困难。Hall 博士表示,“事实上,零部件的几何形状对车辆性能有很大影响,而且也与车辆的整体减重息息相关,也就是说一种材料可以支持的几何形状越多,则降低材料用量的几率就更大,因此也更容易实现减重。很显然,这是铝合金材料的弊端之一。”

许多人可能认为,未来的汽车行业将是电动汽车的天下,且无论自动驾驶汽车还是非自动驾驶汽车均将主要采用铝材和碳纤维材料,但事实上钢材仍将在推进汽车行业革新中发挥至关重要的作用。与同等尺寸的内燃机车辆相比,电动汽车减重带来的实际效益相对较小。

“传统内燃机车型的车身和底盘几乎占车辆总重的一半,因此针对这些部位减重可以给车辆带来相当可观的收益,比如大约0.2 mpg 的燃油经济性提升。”Hall 博士解释道,“但减重对纯电动汽车的帮助要小很多,收益完全无法覆盖为减重本身支付的成本。”然而,一些一级供应商向《汽车工程》分享,未来,铝材料在电动汽车领域应用的主要增长点将集中在电池组部分。

Hall 博士打趣到,“钢材料在汽车行业的应用已经超过100 年了,所以大家可能都以为我们已经没什么可以继续创新的地方了。”事实上,这种想法错的离谱,这点工作在第一线的车身机构工程师是最了解的。

Mobility’s longtime incumbent material maintains its star status for vehicle structures through constant innovation—and a collaborative development model.

by Lindsay Brooke

In 2014, just before Ford shook the industry with the introduction of its aluminum-intensive F-150, Ducker Worldwide released a study for the aluminum industry. The report predicted that the light metal would dominate the North American light-truck segment in the next new-model development cycle. Some seven out of ten pickups in the next round were going to be AL-intensive, the study opined. A tidal wave appeared to be building.

Five years later, not a single pickup has entered production with an AL-intensive cab and bed. While Ford changed over the body structures of its all-new 2018 large SUVs to aluminum, steel rules the midsized 2019 Ranger. In the enemy camps, the 2019 Chevrolet and GMC Silverado and Sierra 1500 and their brawnier HD cousins continue GM’s mixed-materials strategy for pickups and SUVs. FCA’s Ram and Jeep brands have stuck mainly with steel structures; the new JL-series Jeep Wrangler changed to aluminum doors (and hinges), hood, fenders and windshield frame, utilizing Alcoa’s new C6A1 high-form alloy and its 6022 and A951 alloys.

Also contributing to Wrangler’s shedding up to 200 lb (91 kg) is its magnesium rear swing gate—FCA’s reprise to the feathery (and not cheap) Mg lift gate used on the current Pacifica minivan. Underpinning each of these trucks are ladder frames representing the ultimate in finite-element-optimized high-strength steel, with a few AL cross members.

“We’ve migrated from the idea that we need a single- material-intensive vehicle” into an engineering mindset of “the right material, produced the right way and engineered into the right part of the vehicle,” observes Dr. Alan Taub, professor of Material Science & Engineering at the University of Michigan.

Case in PointDrive’s pioneering R1T electric pickup slated for 2021 features a main cab structure tailored for reduced mass and crash safety using various high-strength-steel grades, with aluminum closures.

Even the luxury carmakers are following subtotals abandoned the AL- intensive route used on its Models S and X in planning its high-volume, lower-priced Model 3 and Model Y, both of which have significant steel content. Audi has switched from an AL-intensive strategy on its unibodies to the mixed-materials pathway (even for its new eTron electric vehicle) that is becoming universal across the industry.

“The environment around mass reduction has changed from aluminum-intensive to mixed materials—that’s certainly what automakers are telling us,” notes Dr. Jody Hall, VP of the automotive market for the Steel Market Development Institute. She and Dr. Taub believe steel’s inherent value compared to light metals and carbon composites, along with the steel industry’s aggressive development of new, stronger grades suitable for vehicle use will continue its reign as the “core” material for body structures and chassis systems—for the next decade at least.

A look at the accompanying chart shows the growing number of steel grades based on their strength and elongation. Ranging from about 200 MPa to 2,000 MPa, the bandwidth is significantly wide for that of any single metal. “You’d have to use a reinforced composite to match steel’s strength range,” Dr. Hall asserted, “but the cost to achieve that changes to many times that of the base material. There’s no other material ‘system’ that delivers steel’s range of performance at such a high value.”

‘3rd-Gen’ material blitz

Steel’s appeal to development engineers has been the industry’s continuous innovation-by-collaboration model that began in the 1980s when steelmakers had to defend against a major assault on automotive skins by the plastics industry. “We work with them an industry instead of as individual steel companies,” Dr. Hall explained. “They show us their designs and we work with them to achieve them in a more cost-effective manner.

“That’s not saying individual steel companies don’t work with automakers on their needs, but when we do it as an industry, it’s really appreciated by the customers,” she said. “Because we’re all trying to do more with fewer resources. It’s a very efficient way of getting results, in terms of resources and timing. We’ve been working this way for decades and it continues to pay off.”

The most advanced high-strength (AHSS) and ultra-high-strength (UHSS) steel grades will offer 2,000 MPa tensile performance. The so-called “3rd Generation” AHSS was launched commercially in 2018, from major producers ArcelorMittal, AK Steel and Nucor. The products are a response to OEMs’ requests for more elongation/ductility for a given strength.

“Part of the reason for this request is they didn’t want to use as much press-hardened steel as they do now,” Dr. Hall explained. “They want to use their current infrastructure to stamp, at room temperature, the more complex geometries they couldn’t get with some of those AHSS. they’re looking at reducing cost in their stamping lines.”

Because of the lead times invalidating any new material for automotive use, the roll-out of the 3rd-Generation grades will happen gradually through 2023, when the new grades will enter production vehicle programs in significant volume. Experts note that press-hardened steel will remain available because it enables body engineers to achieve complex geometries with high strength. Honda has engineered it into the A-pillar design of its NSX supercar, in order to minimize the pillars’ cross-section and thus improve driver visibility, and uses 1,500-MPa grade for the inner and outer door rings of the RDX.

Aluminum alloys are lower in formability for the same strength levels; this hurts AL applications “because geometry adds a lot to the performance and can help with mass reduction—the more geometry you can get into a part enables thinner sections in many cases,” Dr. Hall said.

While many may think that future EVs, both autonomous and non-, will be constructed of aluminum and carbon fiber, steel has a major role to play in the propulsion revolution. In an EV, the actual impact of lightweighting actions is reduced compared with combustion-engine vehicles of comparable size.

“When you lightweight a conventional vehicle’s body and chassis components, which make up roughly half the vehicle’s mass, you achieve maybe a .2 mpg improvement; it’s incremental,” Dr. Hall explained. “If it’s a battery-electric vehicle, the improvement would be far less. The [body-structure weight-reduction] gains don’t justify the expense.” EV battery pack structures, however, are a major growth area for aluminum, Tier 1 suppliers tell AE.

“Everybody assumes that we’ve innovated as much as we can, because steel has been around in vehicles for well over 100 years,” Dr Hall quipped. Automotive body structure engineers know how wrong that assumption is.

Author: Lindsay Brooke

Source: Automotive Engineering

等级

打分

- 2分

- 4分

- 6分

- 8分

- 10分

平均分

- 作者:Lindsay Brooke

- 行业:汽车

- 主题:制造材料零部件质量、可靠性与耐久性安全性