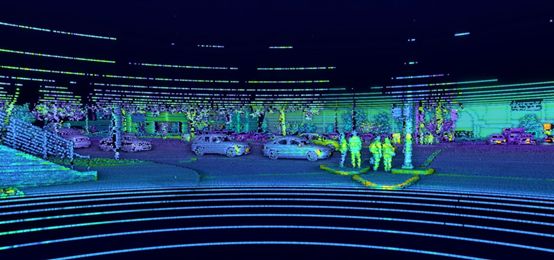

通用 Cruise 自动驾驶汽车集成了大量激光雷达,用于自动驾驶汽车的公共道路测试。 (图像: GM)

通用 Cruise 自动驾驶汽车集成了大量激光雷达,用于自动驾驶汽车的公共道路测试。 (图像: GM) 为了将传感器完全整合至汽车中,缩小激光雷达的尺寸将至关重要。麦格纳的概念车(如图所示)已经迈出了整合的第一步。(图片:麦格纳)

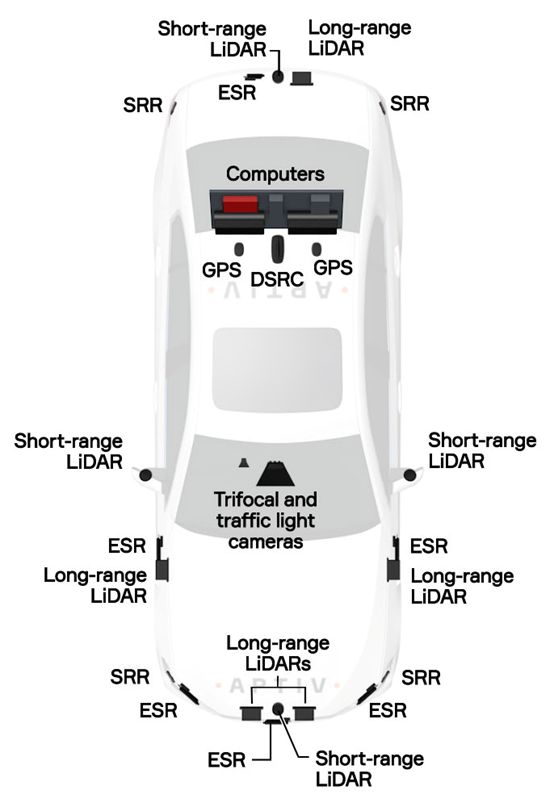

为了将传感器完全整合至汽车中,缩小激光雷达的尺寸将至关重要。麦格纳的概念车(如图所示)已经迈出了整合的第一步。(图片:麦格纳) Aptiv在CES17上使用的BMW 5系自动演示车的传感器布局。 综合阵列包括四个短程激光雷达,五个远程激光雷达,六个扫描雷达(ESR),四个短程雷达(SRR),一个三焦摄像头,一个交通灯摄像头,两个GPS天线,一个DSRC模块和两个 计算机软件堆栈用于冗余。(图像:Aptiv)

Aptiv在CES17上使用的BMW 5系自动演示车的传感器布局。 综合阵列包括四个短程激光雷达,五个远程激光雷达,六个扫描雷达(ESR),四个短程雷达(SRR),一个三焦摄像头,一个交通灯摄像头,两个GPS天线,一个DSRC模块和两个 计算机软件堆栈用于冗余。(图像:Aptiv) Aptive 公司的固定式激光雷达(图片来源:Aptiv)。

Aptive 公司的固定式激光雷达(图片来源:Aptiv)。

稳步发展的激光雷达技术将协助自动驾驶系统实现重大飞跃,但前提是必须降低成本。

顾名思义,激光雷达是指“以发射激光束探测目标的位置、速度等特征量的雷达系统”。事实上,人类历史中对激光雷达的应用可以追溯回 1962 年 5 月。当时,Louis Smullin 和Giorgio Fiocca 两名电气工程师曾在美国麻省理工大学的林肯实验室中,利用一部 12 英寸的望远镜向月球发射 50 焦耳的激光脉冲,并使用一部 48 英寸的望远镜接收反射光,而后通过光的传播速度估算出地球与月球的距离。

40 年后,除了在气象学和阿波罗登月计划中发挥重要作用外,激光雷达还作为关键传感器,成为美国国防部DARPA 挑战赛中机器人汽车原型中的关键组成部分。在最初的机器人汽车设计中,设计人员将多达 64 部激光雷达和传感器集成至安装在车顶的巨大圆柱体中。车辆在行驶时,这个圆柱体系统将不断旋转,向四面八方发射成千上万条脉冲,从而提供 360 度车辆环视信息。具体来说,激光雷达扫射的目标将被标记为“点云”(Cloud of points),补充雷达和摄像头的成像效果,共同引导无人驾驶汽车的行驶。

到 2007 年,也就是DARPA 挑战赛的第四年时,赛事的冠军作品及所有 6 件完成作品中的 5 件均沿用了激光雷达技术先锋Velodyne Acoustics 公司推出的早期激光雷达。据报道称,当时每个激光雷达单元的成本高达近 8 万美元。

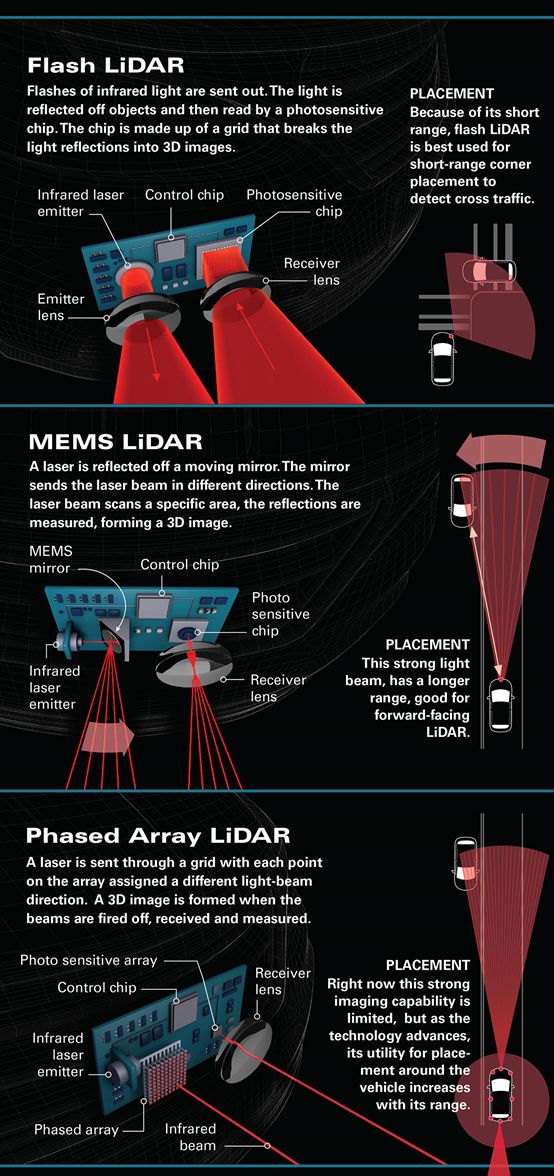

尽管软件和硬件方面都有了重大改变,但如今激光雷达的工作方式却与之前的“祖辈”并无太大变化。专家表示,目前,汽车行业中主要采用久经验证的机械扫描型(MEMS)激光雷达,而新的固定式(无移动组件)激光雷达的性能更可靠、尺寸更紧凑,这对于将设备集成至车辆外饰中至关重要。对比来说,固定式激光雷达的视场(field of view),也就是可视范围较窄,但凭借相对更低的成本,厂商也可以选择同时安装多款固定式激光雷达,从而达到扩大视场的目的。

通常而言,常见的汽车或卡车可以通过安装大概8 个可视角度较小的激光雷达(车辆前后选择可视角度 120 度的激光雷达、左右选择可视角度 90 度的激光雷达)替代360 度的大型激光雷达,当然具体数量仍与车辆的几何外形有关。从另一方面来看,车辆对激光雷达探测距离的需求也可以降低。工程师可以根据激光雷达在车辆安全系统中发挥的作用,对安装在车辆不同位置的激光雷达提出不同的探测距离要求,通常左右方向的激光雷达要求达到 30 米、前方要求200 米、后方要求 50 米。

随着越来越多的初创公司和成熟的供应商均纷纷“杀入”SAE 3 级、4 级和 5 级自动驾驶功能的开发中,激光雷达的研发正在如火如荼地开展。此外。这项技术在需求量巨大的 3D 地图领域也有重要应用。

Frost & Sullivan 公司预测,到 2025 年,激光雷达的年销量将达到600 万部,其中 50% 均将应用至汽车中,市场规模预计将达到 20 亿美元。经《汽车工程》统计,激光雷达领域中的初创公司数量多达 30 多家,还有Velodyne 等老牌厂商及包括博世(Bosch)、法雷奥(Valeo)及大陆集团(Continental)等在内的一级供应商。此外,Aptiv 和麦格纳(Magna)等顶级供应商选择与一些激光雷达专家公司合作。一些汽车厂商也开始通过收购或合作等手段,与激光雷达开发商建立联系,包括BMW(通过麦格纳与Innoviz 合作)、通用(与Strobe 合作)、丰田(与Luminar 合作),及福特(与Princeton Lightware 和 Velodyne 合作)。

有一些支持者称激光雷达是解决“自动驾驶汽车关键难题的灵丹妙药”,这可能有些夸张,但无论如何,在自动驾驶汽车研发方面,激光雷达无疑是最热门,也最有争议的传感器技术。

技术顾问Gerald Conover 在移动出行领域的经验非常丰富。他观察道,“每隔几周就会有一家新公司大肆鼓吹他们的全新激光雷达技术。但事实上,他们口中的成果很多仍仅基于实验室项目结果,而真正的大批量生产可能还需要几年时间。”只有那些成本低且性能高的产品才能真正存活下来。根据SAE 4 级和5 级自动驾驶车辆的发展情况来看,“未来,市场对激光雷达设备的需求可能很大。”

成本仍是汽车级激光雷达设备实现大规模部署的一大障碍。目前,开发版激光雷达的成本仍在10000 美元或更高 — “对于汽车生产来说,这么高的成本是不现实,”Conover 打趣道,“而降低激光雷达成本的关键技术仅掌握在少数几家供应商手中。”汽车厂商希望,未来,激光雷达的商品价格可以稳步降低,正如曾经的车载雷达和摄像头一样。

自2017 年末以来,Quanergy 公司一直在生产905 纳米的固态激光雷达,其反射率为8 %,测距范围为150 米。该公司声称,我们的激光雷达为光学相控阵类型,每秒可以扫描50 万个点,100 米外的最小可监测光点单位为3.5 厘米。Quanergy 公司认为,目前,每个样品的价格仍为数千英镑,但公司有信心在未来的量产中,将产品的单位成本降低至300 美元之下。目前,Velodyne 公司最便宜的 16 束激光雷达每台售价为4000 美元。

物尽其用,各司其职

虽然汽车激光雷达领域的竞争已经达到白热化程度,但并非所有原始设备制造商都认为这项技术势在必行。比如,特斯拉(Tesla)的自动驾驶系统就另辟蹊径地采用了基于摄像头的光学识别技术。这家公司的老板Elon Musk 似乎并不认为激光雷达将改变自动驾驶领域的游戏规则。2017 年4 月的TED 演讲舞台上,“一旦你能解决摄像机的视觉问题,就能解决自动驾驶的问题;如果你不解决视觉问题,自动驾驶的问题自然无解。”Musk 表示,“只要有摄像头,你绝对可以实现成为超人的梦想。”此外,这位CEO 还暗自给激光雷达贴上“拐杖”的标签。

本田北美公司(Honda North America)产品规划助理副总裁Jay Joseph 指出,公司正在“利用激光雷达进行开发和测试”。他表示,我们的工程师认为,激光雷达在短期内是必要的。“当然,从长远来看,我们希望看到其他解决方案——也许是一些借助网联功能和共享信息的解决方案。但是,在新解决方案确保万无一失之前,激光雷达可以为车辆提供高质量的信息,让车辆能够基于这些信息做出正确的决策,因此是必不可少的。”

目前,对于包括Aptiv 等很多经验非常丰富的一级供应商而言,很大程度上,他们的工作是将传感器阵列组装完美地集成至车辆中。Aptiv 公司高级技术副总裁Jada Smith 指出,“一些科技初创公司还对汽车不够了解,但我们明白传感器是如何与车辆协同工作的。”

Smith 表示,Aptiv 认为摄像头、雷达和激光雷达将在汽车自主技术中发挥协同作用。她称,激光雷达是“一项必要技术,适用于所有用例,可作为一种冗余系统,并帮助车辆看清周围发生的一切。”目前,Aptiv 已经投资了Leddartech(flash 激光雷达公司)、Innoviz(MEM 型激光雷达)和Quanergy(光学相控阵型激光雷达)等公司,对各类激光雷达技术均有涉及。

在选择激光雷达类型时,最重要的是搞清楚激光雷达的角色。“我们希望让激光雷达发挥什么作用?”Smith问道,“探测距离越远,视野越窄——这与摄像头的情况一样。因此,我们首先应该确定到底要什么性能,然后再选择Flash、MEMS 或其他类型的激光雷达。但关键是要根据我们希望达到的目标,进行权衡。”

最近,《SAE 汽车工程》深入采访了一群激光雷达创新研究人员,下文将介绍这些研究人员对激光雷达技术对了解和看法。

Innoviz Technologies

如同许多传感器技术开发商一样,Innoviz 公司的总部设在以色列,所有主要负责人均拥有以色列军方的专业电子背景。这家公司成立于三年前,全球共有大约150 名员工。目前,Innoviz 公司已经获得超过8000 万美元的投资,Aptiv、Magna 和三星在Innoviz公司均有持股。

激光雷达的基础技术在于微机电系统(MEMS)的设计,即通过移动的镜面投射来自固态芯片的扫描激光。更为重要的是,Innoviz 还推出了 905 纳米激光雷达。Innoviz 北美总经理Aditya Srinivasan 表示,905 纳米激光雷达可以帮助公司有效降低成本。事实上,Innoviz 公司预计将在 2019 年推出一款定价仅在数百美元的汽车级激光雷达传感器,这也是公司的首款汽车级激光雷达。

Srinivasan 表示,“有关我们的设计到底是不是固定式激光雷达,大家可能会有不同的看法,因为我们确实使用了一面移动的镜子,但无论如何,这就是我们公司的‘固定式’激光雷达。”

Innoviz 公司的资料显示,InnovizOne“经过专门设计,可以轻松无缝集成至任何大众市场车辆中”。该系统的水平和垂直场视角度分别为120° 和25°,可提供750 万像素/秒的高清分辨率,帧率为25 帧/秒,探测范围达250 米(820英尺)。从外观而言,InnovizOne 高 50 毫米、宽 110 毫米、进深 100 毫米(即2 x 4.3 x 3.9英寸)。此外,系统还采用了一款专利信号处理芯片,进行数据管理工作,但Srinivasan 并未透露这家芯片合作厂商的名称。

Innoviz 还声称,InnovizOne系统经过专门优化,可以识别反射率极低的物体,这也是目前很多其他激光雷达很难做到的。

4 月,Innoviz 还公布了通过公司供应商合作伙伴麦格纳(Magna)与BMW 签订的供货协议。BMW 表示,公司计划在2021 年推出一项SAE 3 级自动驾驶汽车叫车服务,而来自Innoviz 的激光雷达无疑将成为其中的关键组件之一。

此外,Innoviz 还与Aptiv 和三星共同合作,开发汽车激光雷达。6 月,Innoviz 表示,公司已经与中国一级汽车供应商恒润科技建立了合作伙伴关系,而后者的客户包括多家中国大型汽车厂商,目前正在将Innoviz 的产品集成至自家的自动驾驶平台。

Aptive 公司的固定式激光雷达(图片来源:Aptiv)。

TetraVue

TetraVue 公司的固定式 Flash 激光雷达技术借鉴了数码相机相对成熟,且更为平价的传感器技术,特别之处在于可以提供更高的分辨率。事实上,这家公司称其汽车激光雷达为“高清4D 摄像头”,可提供百万像素级数字视频捕捉,通过像素级深度信息支持远程传感需求。

TetraVue 公司创始人兼执行副总裁 PaulBanks 拥有应用物理学博士学位。对他来说,分辨率是最关键的。Banks 先生用通俗易懂的语言解释了公司理论上具备的技术优势。他摘下眼镜说,我是个近视,加州决不允许我不带眼镜就开车上路,然而,市场上大多数激光雷达的分辨率却低于加州对人类驾驶员的最低视力要求。

“对我们来说,高分辨率才是最重要的,”Banks直言,“实际上,我们使用的就是你手机里的(图片)传感器,其他产品根本不是我们的对手。”

事实上,Banks 的观点有一定道理,目前博世和三星等投资者对此都很感兴趣。TetraVue 公司的固定式Flash 激光雷达技术借鉴了数码相机领域相对成熟且更为平价的CMOS 和CCD 传感技术。TetraVue 激光雷达采用肉眼不可见的 800 纳米波长,发射速度达每秒 30 帧(30 fps)。此外,这款激光雷达还配备了“照明”功能,可以提供像素级的深度信息。

Banks 向我们展示了一位舞蹈演员通过“常规”激光雷达和 TetraVue激光雷达看到的不同数据场景,TetraVue 产品所提供的更大视角和深度着实让人惊叹。

Banks 表示,“我们的激光雷达更像是一款视频摄像头,无论是从外观,还是使用感受而言。”事实上,Banks 并没有夸张,TetraVue 系统每秒可以展示 6000 万个点,最终的成像效果让其他竞争对手的画质对比来看就像是一些早期的视频游戏界面。

现阶段,对于这家位于美国加利福尼亚洲的激光雷达公司而言,最大的挑战在于探测距离。Banks 表示,按照当下的设计,这款激光雷达的探测距离在 150 米左右(492 ft),而其他竞争对手的产品,比如Velodyne 最新激光雷达产品的距离几乎是TetraVue 的 2 倍。不过,Banks 表示,我们也可以提高探测距离,但“最根本的问题还是成本。”他还表示,公司对这款激光雷达的定位是大众应用市场,也就是说定价将在大众可以接受的范围。

Ouster

内战期间的著名军事学家Nathan Bedford 曾提出,“孤注一掷,占得先机”。在如今的科技时代,Ouster 公司可能是对这一名言贯彻地最为彻底的公司了。

Ouster 公司创始人兼 CEOAngus Pacala 曾称赞称,我们的市场优势在于:我们已经开始向世界各地输送汽车激光雷达了。

“我们的产品根本无需额外推销,”Pacala 夸口说,“我们是市面上最智能,也最轻质的 360 度3D 传感产品”。此外,他还说,Ouster 公司是唯一一家愿意向任何买家,开诚布公地公开技术价格的公司。

Pacala 此前曾在 Quanergy公司担任工程总监。他表示,Ouster 的OS-1 是目前市面上分辨率最高的激光雷达,具有一流的功耗、尺寸和重量指标。该系统每秒可测量130 万点,但功耗还不到15 W。正如TetraVue 一样,该公司的技术也植根于相对成本更低也更为成熟的CMOS 技术(在智能手机和数码相机中均有多年应用历史)。

为了将成本控制在合理范围内,OS - 1激光器的工作波长为850 纳米,成本在某种程度上则根据客户对渠道的不同需求,有“阶梯式”差异:其中,成本最高的版本采用了64 个发射器,可提供每个垂直视场的“切片”,而性能较低的版本仅有16 个通道,因此成本较低。Pacala 表示,该公司预计将在2018 年底出货10,000 至20,000 部OS-1 产品。

OS–1 的尺寸与两个冰球相当,高 2.5英寸(63毫米),直径3.14 英寸(80毫米),重约330 克。这款激光雷达并不属于固定式激光雷达,而是使用了一个可以旋转的发射器,可提供360° 覆盖范围和近32° 的垂直视场,精度约为3 厘米(1.3英寸),但测距范围相对较短,只有120 米(394英尺)。

随着OS–2 的问世,Ouster 的测距范围有所提升,也就是说OS–2 的测距范围将达到200米(656英尺),采用64 通道设计,视场范围 15.8°。不过,OS–2 的尺寸更大,也更重。Pacala 表示,OS–2 将在今年第三季度起售。

Valeo

2017 年底,法国一级供应商法雷奥(Valeo)旗下一款激光雷达正式登陆奥迪(Audi)A8 轿车,这也被视为激光雷达首次登陆一款具备SAE 3 级驾驶员协助功能的量产车型。奥迪A8 的交通堵塞领航系统(Traffic Jam Pilot system)可以在法雷奥 Scala 激光雷达的协助下,在发生交通堵塞的情况下,即车速不超过每小时37 英里(60公里/小时)时,控制车辆的加速、制动和转向功能。

Scala 是法雷奥与 LeddarTech合作开发的创新固定式激光雷达,并荣获2018 年佩斯奖(2018 PACE award)。法雷奥称,Scala 的水平视场范围为145°,测距范围为150 米。LeddarTech 表示,正如许多常见的传感技术一样,Scala 的优势主要在于具有专利的处理方式和算法:“本质上来说,我们采用了一整套软件、算法及专门知识,用于设计或优化各种不同类型的固态激光雷达传感器。”

然而,一些热切的早期技术尝试者可能还无法立刻享受到法雷奥/LeddarTech 激光雷达阵列。在最初阶段,这套系统在许多国家均不支持。奥迪并不愿意在美国及其他法律和监管框架尚不够明确的地区,贸然推出这项功能。

5 月,法雷奥宣布了与中国互联网巨头百度 2017 年成立的开放自动驾驶平台阿波罗公司(Apollo)签署“战略合作”。法雷奥在一份新闻稿中表示,公司将为阿波罗项目提供传感器方面的专业知识,以及“传感器清洁系统,及自动驾驶汽车互联功能方面的丰富经验”。

Steadily evolving lidar sensor technology will offer significant leaps forward in autonomous capability—once cost is reduced.

The acronym stands for Light Detection and Ranging, and LiDAR first showed its potential in May 1962, when electrical engineers Louis Smullin and Giorgio Fiocca used the 12-inch telescope at MIT’s Lincoln Laboratory to bounce 50-joule laser pulses off the Moon, receiving the reflected light with the lab’s 48-inch telescope. Using time-of-flight calculations, the two researchers were first to measure the distance between Earth and its only natural satellite.

Four decades later, after use in meteorology and the Apollo program, lidar emerged as a vital sensor in robotic-vehicle prototypes competing in the U.S. Department of Defense’s DARPA Challenge. With up to 64 lasers and sensors packed in large, roof-mounted cylinders, the ungainly prototypes resembled spinning soup cans when operating. The sensor units swept a 360° field of view around the vehicle, firing thousands of light pulses. Objects that reflected light within the sweep were identified as a cloud of points, supplementing imaging from the multiple radars and cameras also fitted to guide the driverless vehicles.

By 2007, the annual event’s fourth year, the winning vehicle and five of the six finishers had early lidars from technology pioneer Velodyne Acoustics mounted atop their roofs. Each unit reportedly cost nearly $80,000.

Today’s steadily evolving lidar typically functions in a similar fashion as the early units, albeit with new hardware and software. The proven mechanical-scanning types are in the practical lead for automotive use, experts say, while new solid-state (no moving parts) devices are expected to deliver greater reliability, dependability and a compact form factor—crucial for integrating the unit within the car’s exterior skin. Solid-state types typically have a more limited field-of-view (FOV). Their lower cost, however, offers the possibility to employ multiple sensors to cover a broader area.

Depending on vehicle’s exterior geometries determined by styling, a typical car or truck could need up to eight compact lidar units of narrower acceptance angle—120° on the front and rear, 90° on the side—compared with the big 360° unit on the roof. Range can be reduced; engineers are aiming for 30 meters on the side, 200 meters to the front, 50 meters to the rear, depending on how microwave radar is integrated into the vehicle’s safety suite.

Lidar development is booming, as start-ups and established Tier suppliers race to enable SAE Level 3, 4 and 5 automated-driving capability in future vehicles. The technology is also in big demand for 3D mapping.

Frost & Sullivan forecasts sales of 6 million lidar units in 2025—half of them for use in autonomous vehicles, for a projected $2-billion market. Automotive Engineering counts more than 30 start-ups in the field, along with market leader Velodyne and some Tier 1s including Bosch, Valeo, and Continental. Aptiv and Magna are among top suppliers that are partnering with LiDAR specialists. OEMs continue to acquire and build ties with lidar developers, including BMW (Innoviz via Magna), GM (Strobe), Toyota (Luminar) and Ford (Princeton Lightware and Velodyne).

While some advocates have dubbed lidar “the essential piece of the puzzle for self-driving cars,” it is certainly the most discussed and perhaps controversial sensor technology related to autonomous vehicles.

“Every couple of weeks a new company is touting new lidar technology adaptations,” observed veteran mobility-tech consultant Gerald Conover. “Many of their claims are based on lab-project results, so designs producible in high volume may still be some years away.” Only those that deliver high performance at low cost will survive. Depending on the uptake for autonomous vehicles in SAE Levels 4 and 5, however, “the demand for lidar devices could be significant,” Conover noted.

Cost remains the nagging impediment to the mass deployment of automotive-grade units. Development units still cost $10,000 or more—“not a sustainable number for automotive production,” Conover quipped. “The thing standing in the way of this is the necessary expertise to produce working lidar, which is in the hands of only a few supplier firms.” OEMs eventually expect a steady cost-reduction path to commodity status, similar to those of onboard radar and cameras.

Since late 2017, Quanergy has been producing a 905-nanometer solid-state lidar with a range of 150 meters at 8% reflectivity. An optical phased-array type, it can scan half a million points per second with a spot size of 3.5 cm at 100 meters, the company claims. While single-unit samples are priced in the thousands, Quanergy believes high-volume scale will drive per-unit cost below $300. Velodyne’s lowest-priced 16-laser unit costs $4,000 per unit.

Horses-for-courses tech choices

\While the automotive lidar space is white-hot, not all OEMs see the technology as an imperative. Tesla’s Autopilot system uses camera-based optical recognition, and company boss Elon Musk appears unconvinced that lidar is a game-changer. “Once you solve cameras for vision, autonomy is solved; if you don’t solve vision, it’s not solved,” Musk said during a TED Talk in April 2017. “You can absolutely be superhuman with just cameras,” he added. He obliquely labeled lidar “a crutch.”

Honda North America is “doing development and testing with lidar,” noted Jay Joseph, assistant VP of Product Planning. He said Honda engineers believe lidar is necessary in the short term. “Longer-term, of course, we’d like to see other solutions—probably more dependent on connectivity and shared information. But until that’s reliable, lidar is probably necessary to provide good information to the vehicle so it can make good decisions.”

Assembling and integrating the sensor array into the vehicle is an important role that experienced Tier 1s including Aptiv are playing. “We understand how it works with the vehicle; some of the tech start-ups don’t understand vehicles well,” noted Jada Smith, Aptiv’s VP of advanced technology.

Smith said her company wholly believes in the tech triad of cameras, radars and lidar for vehicle autonomy. Lidar, she said, is “a necessary piece of technology, to handle all use cases, provide redundancy, and to help the vehicle see everything going on around it.” Aptiv is covering multiple technology bases with its investments in Leddartech (flash-lidar), Innoviz (MEM type) and Quanergy (optical phased array).

Choosing lidar types is a horses-for-courses engineering exercise. “What roles do we expect them to play?” Smith asked. “The longer the range, the narrower its FOV—same concept as a camera. Depending on what performance we want, we may choose a flash type for one and MEMS for another. It’s tradeoffs, depending on what we’re trying to accomplish.”

Automotive Engineering recently spent time with a group of lidar innovators and brings the following insights into their backgrounds and technologies.

Innoviz Technologies

Like so many sensor-tech developers, Innoviz is based in Israel and several of its principals have specialized-electronics background with the Israeli Defence Forces. Innoviz was founded three years ago and has about 150 employees globally. The company has garnered more than $80 million in investment funding, including stakes by Aptiv, Magna and Samsung.

The foundation technology is a microelectromechanical systems (MEMS)-based design in which movement of the mirror that projects the scanning lasers comes from a solid-state chip. Critically, Innoviz promotes laser scanning at 905 nm, a long-established wavelength that Aditya Srinivasan, general manager, North America, said allows the company to keep a lid on cost—to the point at which Innoviz can offer its first automotive-grade lidar sensor, InnovizOne, starting in 2019 at a cost in the hundreds of dollars.

There may be some contention about whether the Innoviz design should be defined as solid-state, since the system uses a moving mirror, but, “Rightly or wrongly, we’re calling this ‘solid-state,’” said Srinivasan.

The InnovizOne is “designed for seamless and easy integration into any mass-market vehicle,” the company’s literature describes. The system delivers 120°-horizontal and 25°-vertical FOV for high-definition resolution of 7.5 million pixels/sec; the frame rate is 25 frames/sec. Claimed range is up to 250 m (820 ft). The unit’s footprint measures 50 mm high by 110 mm wide by 100 mm deep (2 x 4.3 x 3.9 in.). Data is managed by a proprietary signal-processing chip that’s been developed with “a partner” that Srinivasan chooses not to name.

The company also claims its system is adept at identifying objects with extremely low reflectivity—a performance aspect that to now has been a challenge for many lidar developers.

In April, Innoviz announced a supply agreement with BMW through Innoviz’ supplier partner Magna. BMW said it intends to offer an SAE Level 3 autonomous ride-hailing service in 2021 and Innoviz-derived lidar apparently will be a key component.

Aptiv and Samsung also are partnered with Innoviz for automotive lidar development and in June the company said it formed a partnership with Chinese automotive Tier 1 HiRain Technologies, which supplies several major Chinese automakers and is integrating the components for its own autonomous-driving platform.

TetraVue

The primary differentiation point for TetraVue’s solid-state “flash” lidar technology is high resolution—as well as reliance on long-proven and relatively-inexpensive sensor technology derived from the digital-camera world. In fact, the company refers to its automotive lidar as a “high-definition 4D camera” that essentially fuses mega-pixel digital video capture with lidar for long-range sensing with pixel-level depth information.

Resolution is everything to TetraVue founder and executive VP Paul Banks, who has a Ph.D in applied physics but explains the company’s presumptive technology advantage in plainspoken terms. Banks removes his eyeglasses, saying the state of California would not certify him to drive without them—yet most competing lidar technologies “see” with less resolution than the state’s minimum vision requirement for humans to legally drive.

“For us, that’s what’s important,” Banks said flatly. “High resolution. We actually use the same (image) sensor that’s in your cell phone. We cheat,” he deadpanned.

His argument is a compelling one that’s interested investors such as Bosch and Samsung. Appropriating the well-developed and extremely cost-driven complementary metal oxide semiconductor (CMOS) and charge-coupled device (CCD) sensing technology of digital cameras, TetraVue’s lidar flashes the environment at up to 30 fps with lasers operating at the invisible-to-the-eye 800-nm wavelength. This “illumination” is merged with the high-resolution video-capture to derive depth information at the pixel level.

Banks’ demonstration borders on amazing, as he shows a data scene of a dancer seen with “conventional” lidar and TetraVue’s lidar; the additional perspective and depth from the TetraVue image is patently startling.

“It looks and feels more like a video camera,” Banks said. And he does not exaggerate—showing up to 60 million points per second, the images from the company’s system make the techy-but-still-scratchy visual representations from competitors seem like the visuals from an ancient video game.

The current downside to Vista, California-based TetraVue’s lidar may be a comparative lack of range. The current design, Banks said, has a range of about 150 m (492 ft)—Velodyne’s latest system, for example, boasts a range twice that far. TetraVue’s range may be improved, he said, “but for us, it all comes down to cost.” He said the company is intent on delivering its advanced technology at a price conducive to mass-market application.

Ouster

Founder and CEO Angus Pacala’s Ouster could be the tech age’s embodiment of the military doctrine of the Civil War’s Nathan Bedford Forrest: “Get there firstest with the mostest.”

Pacala extols one of his company’s market advantages as just that: Ouster is shipping automotive lidars today, he said.

“We let our products do the talking,” he boasted of the “smartest, lightest 360-degree, 3D sensing in the market.” He also said his company is the only one to openly and transparently price its technology for any buyer.

Pacala, formerly the director of engineering at Quanergy, said Ouster’s OS-1 is the highest-resolution lidar currently commercially available, and it has best-in-class power consumption, size and weight. The system measures 1.3 million points per second, yet consumes less than 15W. And like TetraVue, the company’s technology is rooted in comparatively low-cost, highly-developed CMOS technology used for years in ever-advancing smartphones and digital cameras.

To keep costs reasonable, the OS-1 lasers operate on the 850-nm wavelength; cost is “laddered” to some degree according to the customer’s need for channels: the highest-cost versions use 64 emitters to deliver each vertical field-of-view “slice,” while lower-performance requirements can cut cost with just 16 channels. Pacala said the company expected to ship 10,000 to 20,000 units by the end of 2018.

The roughly double-puck-sized OS-1 weighs just 330 g and is 2.5 in (63 mm) tall and 3.14 in (80 mm) in diameter. It is not solid-state: the unit spins to emit over the 360° coverage range and nearly 32° vertical FOV. Its accuracy is about 3 cm (1.3 in)—but range is a comparatively abbreviated 120 m (394 ft).

Range is improved with the coming OS-2, which Ouster indicates will have a 200-m (656 ft) range and 64 channels spaced at 15.8°, although the unit is correspondingly larger and heavier. Pacala said the OS-2 would be available in the third quarter of this year.

Valeo

French Tier 1 supplier Valeo late in 2017 achieved the distinction of supplying what is believed to be the first lidar sensing system to be deployed on a series-production vehicle, Audi’s A8 sedan, widely described as using SAE Level 3 driver assistance. The A8’s Traffic Jam Pilot system controls the A8’s acceleration, braking and steering at speeds up to 37 mph (60 km/h), using the company’s Scala lidar.

Scala, a solid-state design developed in cooperation with LeddarTech, won a 2018 PACE award for supplier innovation. Valeo said Scala has a 145° horizontal field of view and range of 150 m. As is typical for many sensing technologies, LeddarTech says its advances are largely in proprietary processing and algorithms: “essentially an ensemble of software, algorithms and know-hows that are used to design or optimize various types of solid-state lidar sensors,” according to company literature.

Some anxious early-adopters won’t find for Traffic Jam Pilot and the Valeo/LeddarTech lidar array just yet, however; the system initially is not available in many countries. Audi was reluctant to introduce the technology in the U.S. and other markets that do not have clearer legal and regulatory frameworks to address conditional autonomy.

In May, Valeo announced a “strategic cooperation” with Apollo, the open autonomous driving platform created by China’s Baidu in 2017. The company said in a release it will contribute to the Apollo project its expertise in sensors, not to mention its “skills in sensor cleaning systems and connectivity between autonomous vehicles.”

Author: Lindsay Brooke & Bill Visnic

Source: SAE Automotive Engineering Magazine

等级

打分

- 2分

- 4分

- 6分

- 8分

- 10分

平均分