Lux Research的分析报告称,锂离子电动车电池组的价格正在稳步下降,这将使电动车价格进一步降低。

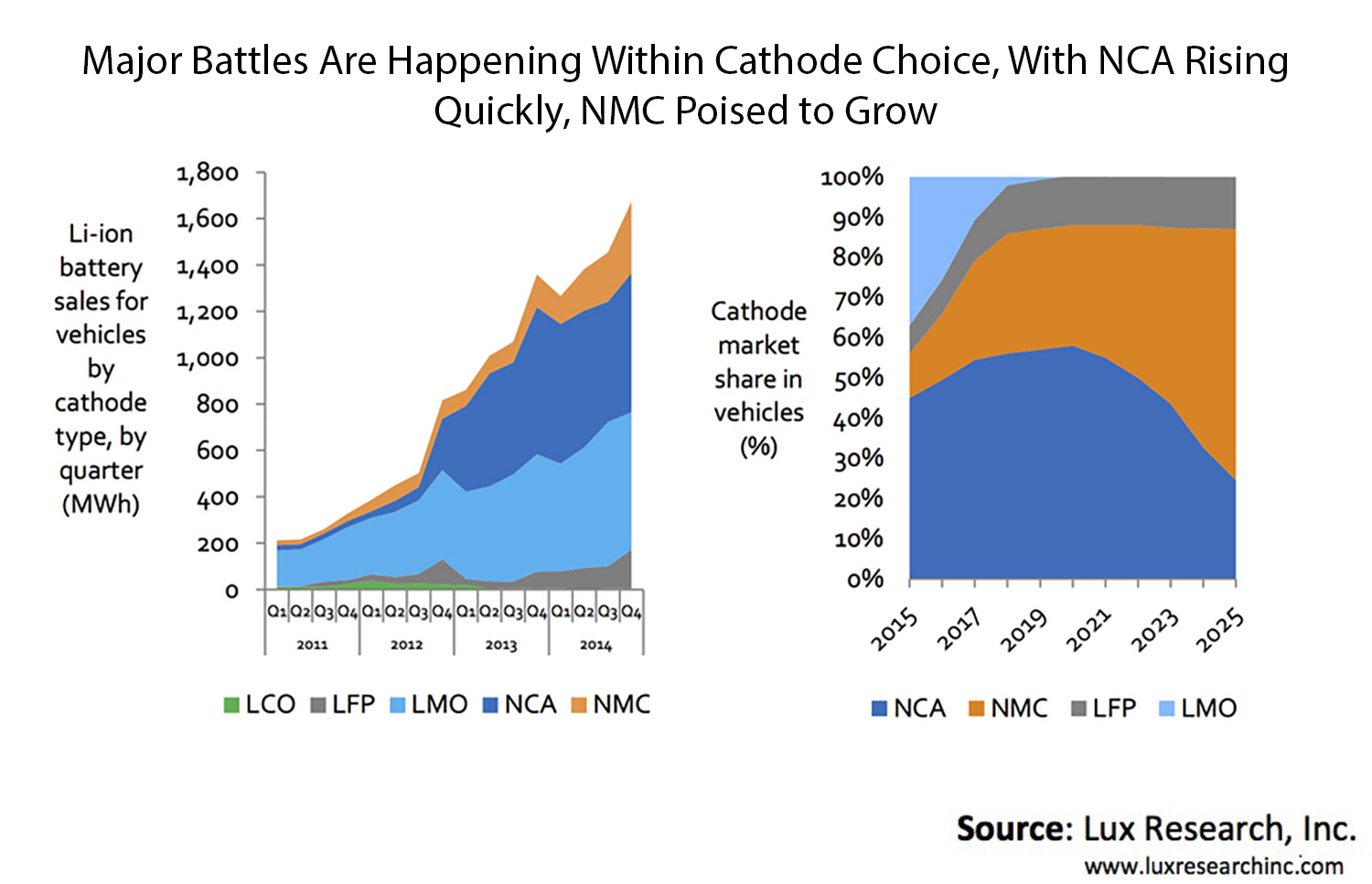

Lux Research的分析报告称,锂离子电动车电池组的价格正在稳步下降,这将使电动车价格进一步降低。 Lux Research的电池专家认为,电动车电池组中最昂贵的部件是电池正极,其生产原料将会逐渐从镍钴铝酸锂(NCA)转换为镍钴锰酸锂(NMC)材料。

Lux Research的电池专家认为,电动车电池组中最昂贵的部件是电池正极,其生产原料将会逐渐从镍钴铝酸锂(NCA)转换为镍钴锰酸锂(NMC)材料。 松下公司与特斯拉正在兴建“千兆电池工厂(Gigafactory)”,为即将投产的Model X 原型车和价格更为实惠的Model 3车型提供能源。

松下公司与特斯拉正在兴建“千兆电池工厂(Gigafactory)”,为即将投产的Model X 原型车和价格更为实惠的Model 3车型提供能源。 每辆特斯拉Model S汽车的电池组中,有6000多个松下圆柱状NCA阴极锂离子电池,即形状系数为18650的电池。

每辆特斯拉Model S汽车的电池组中,有6000多个松下圆柱状NCA阴极锂离子电池,即形状系数为18650的电池。 新型锂离子化学电池,如Faradion公司的钠电池设计方案,有望最终降低电动车电池组成本。

新型锂离子化学电池,如Faradion公司的钠电池设计方案,有望最终降低电动车电池组成本。 2014年10月,韩国公司LG化学开始在中国南京兴建电动车电池工厂。

2014年10月,韩国公司LG化学开始在中国南京兴建电动车电池工厂。

今天的电化学电池就如同现代世界中的魔法石——只要放入电池,就可以把静止的大块头车辆变得动力十足。在这一点上,技术库中的其他任何法宝都无法与之抗衡。

但是虽说汽车电池是一种现代“魔法”,人们对它或多或少总还是有点儿不满:它们耗电太快,充电又太慢,而且还挺沉。要是你打算组合一大堆锂离子电池来驱动电动车开上几百英里,这花费绝对叫人望而生畏。

也难怪目前全球售出的新车中只有0.5%是插电式纯电动车。同样在人们意料之中的是,美国国家研究委员会(US National Research Council)专家组称锂离子电池的高成本、有限续航里程和充电问题这三大短板,是推广插电式纯电动车的主要障碍。专家组2015年发布的《克服推广插电式纯电动车的障碍》报告中提醒读者,如果电池的技术问题得不到解决,那么汽车行业的经济效益和长期持续发展将会受到越来越大的影响。

争取逐渐实现$100/kW·h的电池组价格目标

电动车的规划师与工程师们非常清楚,电池成本是他们面临的最大障碍,而哪家厂商的解决方案能走得更远,也直接关乎其他相关问题能否得到顺利解决。好消息是,电池成本正在稳步下降,而这也把企业逼上了“降低成本的风口浪尖”,Lux Research(新兴技术与市场调研公司)的高级分析师CosminLaslau如是说。

Laslau是《超越极限:锂离子电池的成本降低及其对汽车与固定式蓄电池技术的影响》这一分析报告的首席作者。他解释说,该报告是在对电池制造商、OEM,以及政府与高校研究人员进行采访后,基于所收集的信息完成的。报告中还构建了一个详细的“自下而上的成本模型”,通过比较电池化学原理、形状系数、生产规模、制造地点等其他相关因素等,对未来电池的技术与价格进行评估。

LuxResearch的报告中估计,到2025年,领先的电池制造商(如松下)所制造的锂离子车用电池组的价格将降至$172/ kW·h,较为落后的制造商所提供的电池组价格大约是$229/kW·h。而目前大多数电动车电池组的价格还停留在$400/kW·h左右。

Laslau提到,$200/kW·h的价格水平,将是电动车电池组投入大规模生产的门槛。美国先进电池联盟(U.S.Advanced Battery Consortium)则认为,$100/kW·h的电池组价格水平,才真正标志着电动车销售腾飞的起点。

这一观点与LG化学、博世、通用和特斯拉等企业的预测基本一致。这些机构预测,到2020年底,电池组的价格将降至$300/kW·h。报告提出,如果研发人员能够将电池成本降至$300/kW·h以下,那么10到15年后,电动车制造商将有机会将销售量提升到数百万辆。

“千兆电池工厂”之争

Laslau将电池业描述为竞争激烈、高度隐秘、极其保守,且为几大老牌霸主所占领的行业。要在这些巨头之间进行相互比较是非常复杂的,因为每一家都采取了自己独有的技术路线,Laslau补充道。

报告称,为了有效降低成本,并保证供应链的安全,汽车整车厂和电池制造商正在联合起来,将电池生产的规模拓展到前所未有的水平。

例如,松下和特斯拉正在建设一座耗资50亿美元,产能达到35 GW·h的巨型电池工厂,也就是所谓的千兆电池工厂(Gigafactory)。这座位于内华达州的电池工厂旨在生产出比现有工厂所制造的产品成本低廉30%-50%的单体电池和电池组。松下公司目前在为特斯拉供应的是采用镍钴铝酸锂(NCA)18650圆柱型锂离子电池。每辆特斯拉Model S需要使用到6000多个单体电池,而松下能够以$265/kW·h的价格为特斯拉提供比能量高达250 W·h/kg的电池。

相较之下,其他竞争对手的逊色很多了。Laslau表示,日产-AESC,LG化学和三星SDI目前销售的电池单元仅能提供比能量在140 W·h/kg到170 W·h/kg之间的电池,而在电池的能量密度方面,他们与松下之间也存在着相似程度的差距。这些公司仍然沿用传统的锰酸锂(LMO),生产的是体积更大的棱柱形和袋状的电池单元,因为这两类电池比圆柱形的电池单元更容易集成与管理。

Laslau警告说,除非这些公司能把电池组成本降到$261/kW·h,否则在未来十年内,将会面临远远落后于竞争对手的风险。报告称,这些公司目前正在努力向能量密度更高的镍钴锰酸锂(NMC)电池技术过渡。比如,LG化学的目标是在与“千兆电池工厂”竞争的同时,到2017年使电池比能量达到250 W·h/kg。这家韩国电池巨头称,产能达到3-4 GW·h之后,降低成本的压力就不足为惧了。

Lux的分析报告还对中国的比亚迪作出了预测,认为其到2025年将实现$211/kW·h的电池组成本和 8 GW·h的产能。Laslau认为,虽然磷酸铁锂单体电池的电压较低,但是比亚迪还是偏好使用磷酸铁锂电池技术,因为他们觉得这种电池更安全,更经济,在能量密度相对较低的电池中是不错的选择。

另一家重量级厂商是在中国积极发展业务的美国电池制造商——波士顿电池,该公司生产的钴酸锂(Lithium Cobalt)单体电池比能量可达200 W·h/kg。据新闻报道,该公司于2014年12月获得了中国政府机构2.9亿美元的“财政支持”,用以将其电池工厂的产能扩大到4 GW·h。

价格战正在酝酿之中?

Laslau认为,生产工厂的选址十分重要。日本生产的单体电池比中国生产的同等大小和形状系数的产品价格高15%,原因是中国的劳动力、原材料和土地成本都更低,而本地化的高效供应链也是一大优势。选择Co-location的本地化生产模式,让制造商能够对供应商施加更多的影响,最终降低成本,并获得当地政府更多的支持。

LuxResearch的这篇报告肯定了电池正极是锂离子电池中花费最高的部件,因为其原料中包括价格昂贵的镍,钴和锂。举例来说,一家产能为1-GW·h的韩国工厂所生产的镍钴锰酸锂(NMC)袋状电池的正极材料所耗费的成本占到电池总成本的25%,而其余的成本组成分别为:电池组管理系统-16%,电池组热学系统-8%,负极材料-8%,生产设备折旧-8%,电池单体生产人工成本-8%,电池单体制造的土地使用成本-6%,电池单体固定成本-6%,电池组生产人工成本-5%,集流器-3%,电池隔膜-3%,电解质-1%。

Laslau认为,插电式电动车电池的价格在未来十年的发展趋势难以预测,“在未来5到10年,我们有可能会看到行业的整合,也许市场上只会剩下两三家大型供应商,这意味着要争取市场份额,企业之间将会进行激烈的价格战”。

Today’s electrochemical battery is like a latter-day philosopher’s stone—just insert and inanimate objects spring to life. Nothing else in our technological arsenal can compare.

But despite this bit of modern magic, everybody has a beef with batteries. Their charge runs out too soon, and takes too long to recharge; they weigh too much, etc. And when lots of lithium-ion (Li-ion) batteries are ganged together to propel an electric vehicle (EV) several hundred miles, the cost quickly becomes prohibitive.

It’s little wonder then that less than 0.5% of new cars sold worldwide are plug-in vehicles. It’s also no surprise that a panel of U.S. National Research Council experts cited the high costs as well as range and recharging shortcomings of Li-ion batteries as the principal obstacles to widespread adoption of plug-in vehicles. Their 2015 report, “Overcoming Barriers to Deployment of Plug-in Electric Vehicles,” warns that inadequate battery technology, if not addressed, will increasingly limit the auto industry's profitability and long-term sustainability.

Toward the $100/kW·h pack, slowly

Electrified vehicle planners and engineers know that battery cost is their principal impediment and the issue whose solution would go a long way toward resolving most other problems. The good news is that those costs are falling slowly but steadily, leaving the industry “on the cusp of affordability,” said Cosmin Laslau, senior analyst at Lux Research, a technology and market research firm.

Laslau is the lead author of an analysis titled “Crossing the Line: Li-ion Battery Cost Reduction and Its Effect on Vehicles and Stationary Storage.” The study, he explained, is based on interviews with battery builders, OEMs, and government and university researchers. It also includes a detailed “bottom-up cost model” to account for the differences in battery chemistry, form factor, production scale, manufacturing locations and other issues when assessing forthcoming battery technology and future prices.

The Lux report estimates that by 2025, Li-ion EV battery pack prices from a leading manufacturer such as Panasonic should fall to $172 kW·h, while the “laggard manufacturers” should achieve pack prices around $229/kW·h. Most automotive packs currently cost around $400/kW·h.

Laslau said a $200/kW·h pack price is considered to be the entry point to a large-scale EV market. EV sales would truly take off at a $100/kW·h price point, according to the U.S. Advanced Battery Consortium.

This scenario generally aligns with predictions by LG Chem, Bosch, GM and Teslathat battery pack prices will trend toward the $300/kW·h level by 2020. If developers can drive price down to $300/kW·h or less, the report stated, EV makers will have a chance to sell millions of units by the mid- to late 2020s.

Bucking the 'gigafactory' trend

Laslau characterized the battery business as a fiercely competitive, highly secretive and strongly conservative industry with several large and long-established incumbents. Comparing their efforts is complicated by the fact the each player is taking its own particular technological path, he added.

Automotive OEMs and battery builders are joining forces to scale up production to unprecedented levels in the quest for cost reduction and supply chain security, the report said.

Panasonic and Tesla, for example, are pursuing economies of scale by building a colossal $5-billion, 35 GW·h-capacity battery plant. The so-called “Gigafactory” in Nevada is designed to spit out cells and packs that would cost from 30% to 50% less than the incumbent industry's current product. The Japanese company currently supplies Tesla with small, 18650-form-factor Li-ion cells featuring nickel cobalt aluminum (NCA) cathodes. These cells, over 6,000 of which power each Model S sedan, deliver a high specific energy of 250 W·h/kg at a cost of $265/kW·h.

Meanwhile, competitors appear to trail significantly. Nissan-AESC, LG Chem andSamsung SDI currently sell cells that offer between 140 W·h/kg and 170 W·h/kg, and lag in energy density by a similar amount, Laslau said. Their larger prismatic and pouch-type cells are simpler to integrate and manage versus cylindrical cells, and traditionally use lithium manganese oxide (LMO) chemistries.

These companies risk falling behind during the coming decade with packs costing $261/kW·h unless they upgrade their production methods, he cautioned. They are now transitioning toward greater use of the more energy-dense lithium nickel manganese cobalt (NMC) family, the report stated. LG Chem, for example, is aiming at 250 W·h/kg by 2017 while bucking the ‘gigafactory’ trend. The South Korean battery giant claims that meaningful cost reductions taper off after 3 to 4 GW·h of production capacity.

The Lux analysis in addition predicts that China’s vertically integrated BYD will achieve $211/kW·h pack costs by 2025 by pushing capacities up to 8 GW·h. BYD favors cells with lithium iron phosphate chemistry, which it claims is a safer, cheaper, alternative with somewhat less energy density—though the cells are “tweaked to increase voltage,” according to Laslau.

Another big player is Boston-Power, a American/Chinese maker of “lithium cobalt” cells that offer 200 W·h/kg. In December 2014 the company received $290 million in “financial support” from Chinese government agencies to scale its battery factories up to 4 GW·h capacity, according to press reports.

Price war brewing?

Production plant location matters, Laslau noted. Cells that are made in Japan cost 15% more than those of equivalent size and identical form factor manufactured in China because of lower labor costs, cheaper materials and land, as well as a localized, efficient supply chain. Co-location also enables makers to exert more influence on suppliers to reduce costs and extract incentives from local governments.

The Lux report confirmed that the cathode remains the most costly components of Li-ion batteries because they contain high-priced nickel, cobalt and lithium. For NMC pouch cells made in a 1-GW·h South Korean factory, for example, the cathode accounts for about 25% of the total pack cost. The remaining costs break down as follows: battery pack management system—16%; pack thermal system—8%; anode materials—8%; depreciation of equipment—8%; cell labor—8%; land cost for cell manufacturing—6%; cell fixed costs—6%; pack labor—5%; current collectors—3%; separators—3%; and electrolytes—1%.

Just how plug-in battery prices will fare over the next decade is hard to predict, Laslau said.

“In 5 or 10 years we may see consolidation, with only two or three big suppliers remaining. That could mean a price war to capture market share,” he noted.

等级

打分

- 2分

- 4分

- 6分

- 8分

- 10分

平均分