蒂森克虏伯的InCar plus项目包括30个子项目,拥有超过40个独立解决方案,致力于实现有成本优势的轻量化设计。

蒂森克虏伯的InCar plus项目包括30个子项目,拥有超过40个独立解决方案,致力于实现有成本优势的轻量化设计。 “一般来说,InCar中的部件不会在量产车中原封不动地使用,因为技术仍在不断演进。”蒂森克虏伯的Timo Faath表示。

“一般来说,InCar中的部件不会在量产车中原封不动地使用,因为技术仍在不断演进。”蒂森克虏伯的Timo Faath表示。 蒂森克虏伯的InCar plus项目探索了多种B柱解决方案,包括热压成型和冷压成型。

蒂森克虏伯的InCar plus项目探索了多种B柱解决方案,包括热压成型和冷压成型。 Faath表示,InCar plus的TriBond材料确实是为B柱应用研发的,但这种技术或许更适合车辆前后纵梁的应用。

Faath表示,InCar plus的TriBond材料确实是为B柱应用研发的,但这种技术或许更适合车辆前后纵梁的应用。 TriBond 1200 和1400在测试中展现了非凡的延展性,而且不会开裂。

TriBond 1200 和1400在测试中展现了非凡的延展性,而且不会开裂。

ThyssenKrupp explores steel innovations

蒂森克虏伯探索钢材创新

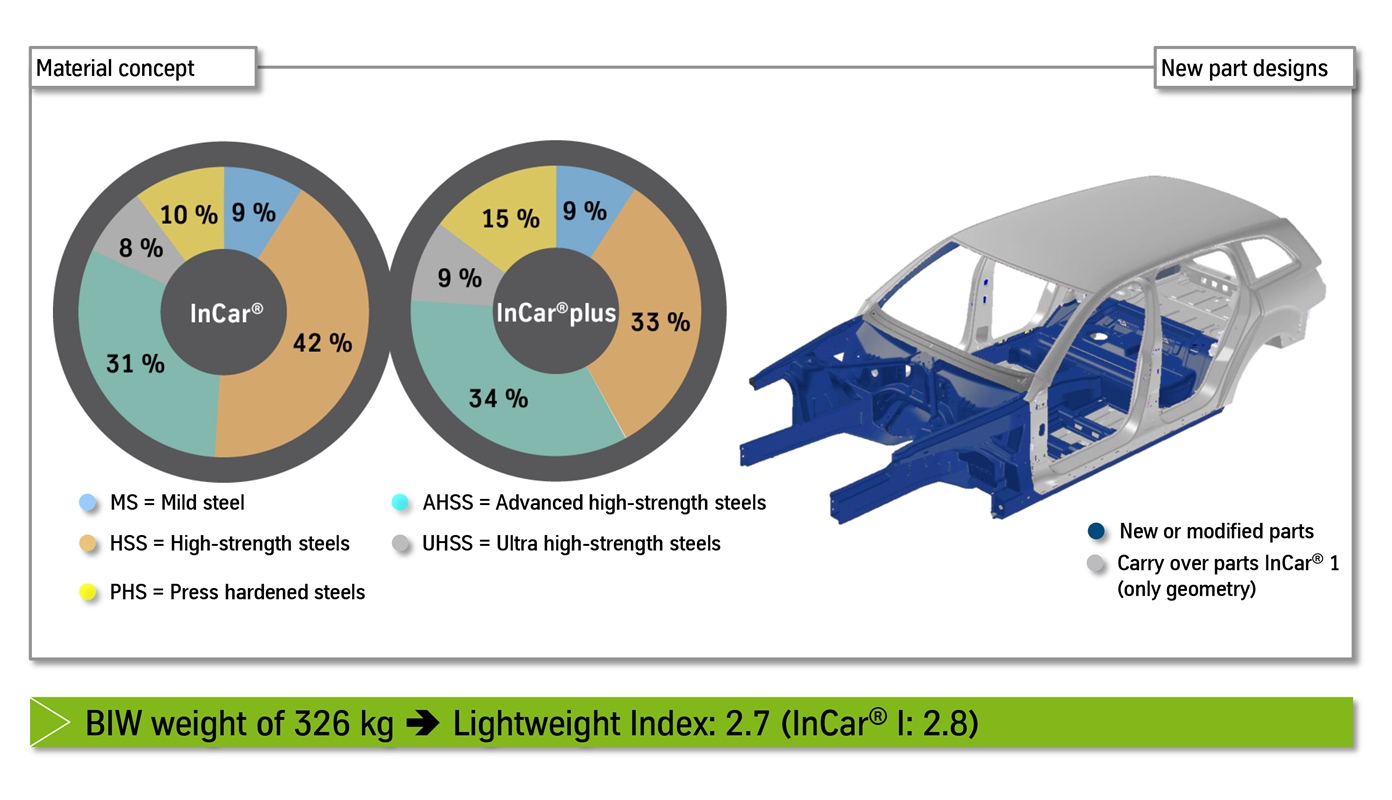

InCar plus是蒂森克虏伯(ThyssenKrupp)公司迄今为止规模最大的内部研发项目。该项目融合了集团内部多学科专业知识,打造了超过40个独立解决方案,可以在不影响车辆性能的前提下实现有效减重。项目也采用了多种经验证的高级制造技术,可以在现行的生产流程中使用。该项目的另一个特点是规模化应用,公司坚持模块轻量化设计概念,所有模块可以在多平台、多项目中使用。起初,项目打造了一款独立的白车身结构,为多种车身解决方案提供了参考基准。这款参考白车身是一辆高端中型车,具有高度代表性,其研发过程广泛对比并参考了多家整车厂的设计。由于设计方面的优化和高级材料的使用,该车身的轻量化指数为2.7,优于蒂森克虏伯于2009年研发的上一款InCar参考结构。蒂森克虏伯钢铁北美公司技术总经理Timo Faath与《汽车工程杂志》探讨了公司的InCar plus项目,以及与此相关的有发展前景的技术。Faath负责区域汽车技术、客户项目工程、产品策略和质量管理。

InCar plus项目的创新成果之一是B柱的改进,采用了新型TriBond材料,您能谈谈研发过程吗?

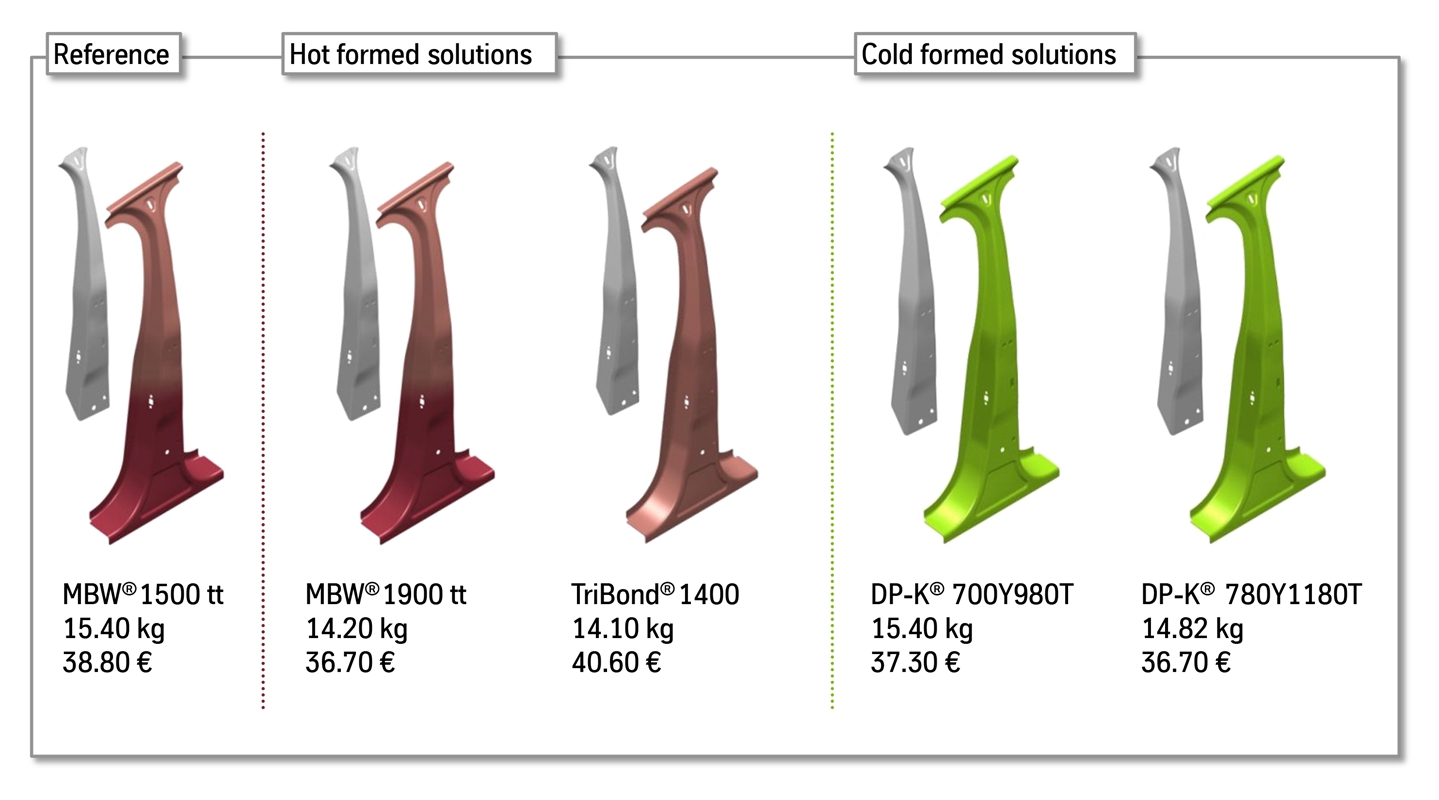

我们有多种B柱解决方案。我们的参考结构采用的是MBW 1500不等温热成型(tt)解决方案。我们也研发了一些热压成型解决方案——其中之一是MBW 1900 tt,另一个是TriBond 1400,采用了新材料研发。此外,我们还能提供一些冷压成型解决方案,比如DP-K 700Y980T和DP-K 780Y1180。TriBond还在新材料研发阶段,尚未实现量产。这种材料就像是三明治。我们会将经过简单处理的三层平板叠在一起,然后依次送入热轧机、冷轧机、热处理系统,最后在表面涂一层铝。唯一需要新增的流程就是堆平板,内板是常规的MBW 1500,而外板较薄、坚韧度也更低。这种设计的效果是…不开裂(经下落测试和3点弯曲测试验证),延展性更高,而坚韧度几乎不变。在机械性能方面,材料的延伸率主要还是由内板决定,仍然维持在4.5%-5%。新材料的弯曲角有了很大提升,常规1500的弯曲角为65°,有TriBond 1400可以提升至85°,而TriBond 1200在实验中可弯曲至135°。所以,这才是材料真正的亮点…这是一种整体材料,可以直接通过常规的热压成型工艺获得,无需修正工艺。我们对此感到很兴奋。

新材料的成本如何?

在成本和减重比较方面,我们的参考结构——MBW 1500 tt B柱的重量约为15.4kg,而TriBond 1400方案的重量可以降低至14.1kg。老实说,对我们来说计算材料成本有点困难,因为还没有(投产)。与常规材料(38.80欧元)相比,我们多一个工艺步骤,所以成本确实有所增加,但今后很可能会下降(目前约为40.60欧元)。新解决方案的减重表现卓越,成本只是略有增加,还是很有吸引力的。我们也有一些(InCar plus项目的)解决方案,不但能够减重,成本也有下降,因为节省了材料,而材料成本是零部件成本中最高的。有时候这些方案对于我们很有利,还是很有吸引力的。

这种材料可以实现其他应用吗?

当然,这种材料完全可以用在B柱以外的其他领域。前纵梁就可以用。我曾经展示过前纵梁的下落测试,结果看起来非常不错。在目前的技术条件下,不能用热压成型工艺处理汽车前纵梁,因为部件延伸率不够。但有了TriBond材料,我们就可以用热压成型工艺处理前后纵梁中需要变形的部分了。可能这种应用比B柱的应用效果更令人满意。其实现在已经有很多高成本的B柱解决方案了,比如不等温热成形,激光拼焊,连续变截面辊轧板等,但从热压成型工艺的角度来看,这些工艺的控制流程非常复杂。但有了TriBond,直接把材料放进热压成型机,就能得到一个有延展性的部件了。

您还介绍了InCar plus项目中的A柱和保险杠的应用概念,这其中哪些技术最接近量产阶段?

这很难回答。对InCar项目来说,我们尝试实现不同水平的量产。其中一些解决方案客户现在就能购买,还有一些仍在研发之中。这样做是因为我们的客户有不同的需求——一些客户正在研发下一代汽车,而一些客户的当下的量产车型有困难,需要解决方案。我们也是在尽可能争取更多客户。一般来说,热压成型是热门技术,我们也知道很多整车厂(特别是欧洲的公司)也在尝试自己进行研发。我个人认为,对热压成型技术来说,整车厂并不希望投资于常规方法,或者说,他们一定不愿意投资于一些供应商已经可以提供的热压成型技术,他们希望获得更精细的解决方案。(InCar项目中的)一些解决方案,比如不等温热成型技术,是非常有潜力的,我认为今后北美自贸区会越来越多地使用这些技术,而且欧洲已经开始使用了。我们展示的所有方案,只要与热压成型有关,基本上都很有潜力。

InCar plus项目还会继续吗?还是不同的解决方案会走向独立的研发道路?

我们一直在说,InCar plus项目研发出了40多个解决方案,但如果详细分析整个过程,我们的研发成果远不止于此。但并不是每一个解决方案都切实可行,或满足我们需要的性能要求。我们选出的40个方案质量非常高,也能带来很多回报。现在我们会一家家拜访不同的整车厂,向他们展示我们的研发成果,希望将我们的想法融入他们的研发项目,将我们的产品整合至他们的汽车和业务。这样技术也能不断演进。一般来说,InCar中的部件不会在量产车中原封不动地使用,不过这也是我们研发InCar项目的原因。我们希望与客户一直保持沟通。

作者:Ryan Gehm

来源:SAE《汽车工程杂志》

翻译:SAE上海办公室

ThyssenKrupp explores steel innovations

InCar plus is the most extensive internal R&D project that ThyssenKrupp has ever undertaken. It encompasses the group’s interdisciplinary expertise to generate more than 40 individual solutions for cost-effective vehicle weight reduction without sacrificing performance, as well as the use of advanced manufacturing technologies that are validated and can be implemented with current processes. Another component is scalability, with modular lightweight design concepts that can be utilized across multiple platforms and vehicle programs. The project was initiated by developing an independent body-in-white structure to serve as a reference benchmark for the various body solutions. The reference structure is a representative upper midsize class vehicle that was derived through extensive comparative studies of bodies manufactured by various OEMs. With a lightweight index of 2.7, it surpassed its previous InCar reference structure that was developed in 2009, due to improved design and advanced material utilization. Timo Faath, General Manager Technology, ThyssenKrupp Steel North America, Inc., spoke withAutomotive Engineering about the InCar plus project and some of its promising technologies. Faath is responsible for the areas vehicle technology, customer project engineering, product strategy, and quality.

One of the project’s innovations is a B-pillar featuring a new TriBond material. Can you talk about this development?

We have several different solutions for the B-pillar. Our reference structure is already a MBW 1500 tailored tempered (tt) solution. We’ve developed some hot-stamped solutions—one is MBW 1900 tt and the other is TriBond 1400, a pretty interesting new material development. And we also have some cold-stamped solutions—DP-K 700Y980T and DP-K 780Y1180. TriBond is a material development; we don’t have it in serial production yet. It’s like a sandwich material. We take three slabs, to simplify it, stacked on top of each other and run them through the hot rolling mill, the cold rolling mill, annealing, and offer it as aluminized-coated. The only process that is added is that stacking up of the slabs. The slab in the middle is a conventional MBW 1500; the thin outer slabs are lower strength. What that does for us is…no cracks [in drop tower and 3-point bending tests], higher ductility with almost the same strength level. When you look at the plain mechanical properties, the elongation is still defined by the core slab—it’s still 4.5-5% elongation. What’s really better for that material is the bending angle—for a conventional 1500 it’s about 65°, with the TriBond 1400 it goes up to 85°, and the TriBond 1200 it’s actually where the test ends at 135° bending angle. So this is the real highlight of that material…It is a monolithic material that can be stamped in a conventional hot stamping process—no process modifications necessary. So this is pretty exciting for us.

How does the new material compare cost-wise?

For a cost and weight comparison, our reference structure—the MBW 1500 tt B-pillar—weighs about 15.4 kg, and with our TriBond 1400 solution we were able to get the weight down to 14.1 kg. To be honest with you, it’s kind of difficult for us to do cost calculations on the material because it is not [in production yet]. We do see an increase compared to the conventional material [€38.80] just because we have an additional process step, but this may well go down a little [currently stated as €40.60]. So very attractive weight and slightly higher cost make the solution very attractive. We have a couple solutions [in InCar plus] where the weight reduction comes with reduced cost, just because you save material and material cost is the biggest portion of your part cost; that sometimes works in our favor. But it’s still attractive.

Any other possible applications for the material?

It doesn’t have to be a B-pillar. So we have a couple of different applications for that material. It will work for front rails as well…I showed a drop tower test of a front rail that looked very good. In today’s vehicles, you don’t use hot stamping for front rails because it’s not enough elongation in the part. But with TriBond we would actually have that option to use it in front and rear rails where deformation is required. That might actually be a better application than the B-pillars. But in B-pillars there’s a lot of expensive solutions out there—tailored tempering, tailor welded blanks, tailor rolled blanks—that are very complicated to control from a hot-stamping-process perspective. With the TriBond, you just throw it in your hot stamping press and you’ve got a ductile part.

You have also presented A-pillar and bumper concepts as part of InCar plus. Which of these technologies is closest to serial production?

That’s a tough one. Throughout the InCar project we tried to offer different serial production levels. Some of the solutions our customers can buy today. Some solutions are still under development. The reason why we do it like that is our customers—some of them work on next-generation vehicles, and some of them have a problem today with their serial production vehicle where they need a solution. So we’re trying to reach as many customers as possible. Generally speaking, hot stamping is a big topic for everybody, and we know there’s some OEMs trying to do it themselves [particularly] in Europe. Whenever OEMs invest in hot stamping, I don’t think they want to do it the conventional way—or follow what their suppliers already do for them—they want to come up with more sophisticated solutions. Some of the stuff [in InCar], tailored tempering being one of them, is very promising and I think we’ll see a lot more of that in the future in NAFTA; it’s already out there in Europe. Pretty much everything that we show [related] to hot stamping is very promising.

Is InCar plus still ongoing? Or are the individual solutions taking different development paths now?

We keep pointing out that 40 solutions were developed; actually if you look into the process, we’ve developed much more than that. But not every solution turned out to be feasible or show the performance that we needed. The 40 we selected are really good and show a lot of benefit. We do road shows—we go from OEM to OEM and present the results—we get engaged in engineering projects where we try to adopt our ideas, our products into their vehicles, into their package situation. And then typically the technologies evolve. We’re not usually seeing the exact same part as we had it in InCar in a serial production vehicle, but that’s why we do it. We want to get in conversations with our customers.

Author: Ryan Gehm

Source: SAE Automotive Engineering Magazine

等级

打分

- 2分

- 4分

- 6分

- 8分

- 10分

平均分